Latest Helium News

4 months ago

Helium Mobile: Price Surge and Future Predictions

In recent weeks, Helium Mobile has seen a remarkable price increase of nearly 125%, reaching $0.0022 on December 1st. However, in the last 24 hours, the token has experienced a slight decline of approximately 1.5%, bringing its current trading price to $0.00134. Helium Mobile, which launched in December 2023, is a decentralized mobile network service that integrates the Helium Network's peer-to-peer infrastructure with the Solana blockchain and partners with T-Mobile for 5G connectivity. The token serves as the network's built-in cryptocurrency, incentivizing users to deploy personal 5G hotspots that enhance the network's infrastructure.

The primary function of Helium Mobile's token is to reward users who contribute to the network by setting up hotspots, which act as localized cell towers. Participants earn MOBILE tokens that can be used within the Helium ecosystem or traded externally. The token supports various applications, including decentralized connectivity solutions for IoT devices, package tracking, drone navigation, and lost pet recovery. As more users join the network, its strength and community-driven nature grow, fostering a robust decentralized mobile infrastructure.

Looking ahead, analysts have varying predictions for Helium Mobile's price trajectory. CoinCodex suggests a potential surge of over 236%, with the token possibly reaching $0.004574 by January 2025. DigitalCoinPrice anticipates that MOBILE could surpass its previous high, projecting a price range between $0.00287 and $0.00299 by the end of 2024. However, Wallet Investor offers a more conservative outlook, estimating a maximum price of $0.00183 by December's end. For 2025, predictions range from $0.000226 to $0.00356, while by 2030, estimates suggest MOBILE could trade between $0.003684 and $0.0123. Despite the optimistic outlook, potential investors should remain cautious, as the cryptocurrency market is inherently volatile.

4 months ago

Helium (HNT) Price Surges to New Nine-Month High Amid Bullish Sentiment

The Helium (HNT) token has recently experienced a significant price surge, recording an impressive 8.36% increase within a 24-hour period, reaching a new nine-month high. This upward momentum is accompanied by a trading volume of $59.31 million, reflecting a robust interest in the altcoin. Over the past week, HNT has surged by 35.17%, and a remarkable 42.76% over the last 30 days, indicating a strong bullish trend. Currently, Helium maintains its value above the $8.5 mark, with a Year-to-Date (YTD) return of 27.59%, positioning it at the 85th spot in the cryptocurrency market with a market capitalization of $1.503 billion.

Technical indicators suggest that the bullish sentiment surrounding HNT could continue, with price targets set at $9.510 and $11.070. The Relative Strength Index (RSI) is nearing the overbought territory, while the 50-day and 200-day Exponential Moving Averages (EMA) show a consistent uptrend. This technical analysis hints at a potential continuation of the bullish price action throughout the week. However, market volatility remains a concern, and traders are left wondering whether HNT can maintain this momentum and reach a new 52-week high or if a correction is on the horizon.

Looking ahead, if bullish sentiment prevails, HNT may retest its resistance level of $9.510. Conversely, should bearish trends emerge, the price could drop to its support level of $8.010, with further declines potentially reaching a low of $6.525. The all-time high for Helium stands at $55.22, recorded on November 13, 2021, raising questions about the long-term price prospects of the token. As traders and investors monitor these developments, the future of HNT remains a topic of keen interest in the cryptocurrency community.

4 months ago

Network3: Revolutionizing Edge AI Infrastructure

Network3: Revolutionizing Edge AI Infrastructure

On November 26, CZ(Binance founder) tweeted, 'I am not against memes, but meme coins are getting 'a little' weird now. Let's build real applications using blockchain.' The market's obsession with meme coins has overshadowed utility-driven blockchain projects like Network3, a decentralized Edge AI infrastructure project poised for significant growth.

Network3 integrates blockchain tokenomics, decentralized physical infrastructure networks (DePIN), federated learning, and Edge AI to challenge big tech's AI monopoly. With over 543,010 nodes across 185 countries, Network3's decentralized federated learning framework ensures privacy and data security while incentivizing node participation. The project's rapid growth, surpassing Helium in node count, signifies its potential to democratize computing power and data.

Market Potential and Tokenomics

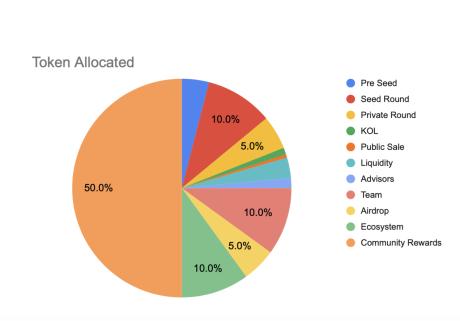

The DePIN and Edge AI combination presents a trillion-dollar opportunity. DePIN incentivizes users to contribute physical resources, projecting a market size of $3.5 trillion by 2028. Currently undervalued at $1.33 billion, the DePIN sector is poised for exponential growth. Edge AI, with a projected market size of $269.82 billion by 2032, excels in data privacy and efficiency, attracting tech giants like NVIDIA and Google. Network3's tokenomics model, with a total token supply of 1 billion, ensures sustainable mining rewards through staking and mining.

Investing in Network3

Investing in Network3 offers a gateway to the future of AI infrastructure, combining DePIN's physical world integration and Edge AI's decentralized computing power. With a clear economic model and exponential market potential, Network3 stands out as a pioneer in revolutionizing the AI sector.

4 months ago

Edge AI Revolutionizing Data Processing at the Edge

375ai Revolutionizing Data Processing at the Edge

As the world becomes increasingly interconnected through millions of smart devices, the demand for rapid data processing at the edge—right where the data is generated—is greater than ever. Edge AI enables intelligence where data is generated, on highways, bustling streets, in hospitals, and retail stores. It operates at the network's edge, making sense of the unstructured, real-time data that represents our world. 375ai has been at the forefront of Edge AI innovation, leveraging cutting edge proprietary hardware and strategic partnerships to pioneer the world’s first decentralized edge data intelligence network. After years of development, we’re thrilled to announce the launch of the 375go Discovery Testnet.

Why Edge AI and Why Now?

Edge AI deploys artificial intelligence on devices throughout the physical world, bypassing the need for centralized cloud processing. Recent advancements in AI, Internet of Things (IoT) devices, and computing infrastructure make edge AI not just possible but essential. The benefits include: Real-time Decision-Making, Increased Privacy, Reduced Costs, Adaptability, and Resilience. The explosive growth of IoT devices has resulted in a deluge of data—from a wide variety of sensors to mobile phones and traffic cameras. Instead of sending all this data back to centralized servers for analysis, edge AI makes it possible to process and act on that data locally. This results in lower costs, faster response times, enhanced privacy, and even autonomy in the absence of internet connectivity.

4 months ago

The Rise of Decentralized Physical Infrastructure Networks and Consumer Engagement

In 2013, Helium was founded to create a wireless infrastructure that could support the rapidly growing Internet of Things (IoT) industry. By 2018, the company pivoted towards a decentralized wireless network model, allowing devices worldwide to connect to the Internet without relying on traditional, power-hungry satellite systems or costly cellular plans. Utilizing token incentives, Helium's network expanded rapidly, boasting over 375,000 hotspots and establishing itself as the largest long-range wide-area network (LoRaWAN) and the fastest-growing cellular network. This innovative approach has inspired over 1,400 Decentralized Physical Infrastructure (DePIN) projects, collectively valued at over $53 billion, demonstrating the potential of blockchain technology to create real-world value through decentralized systems.

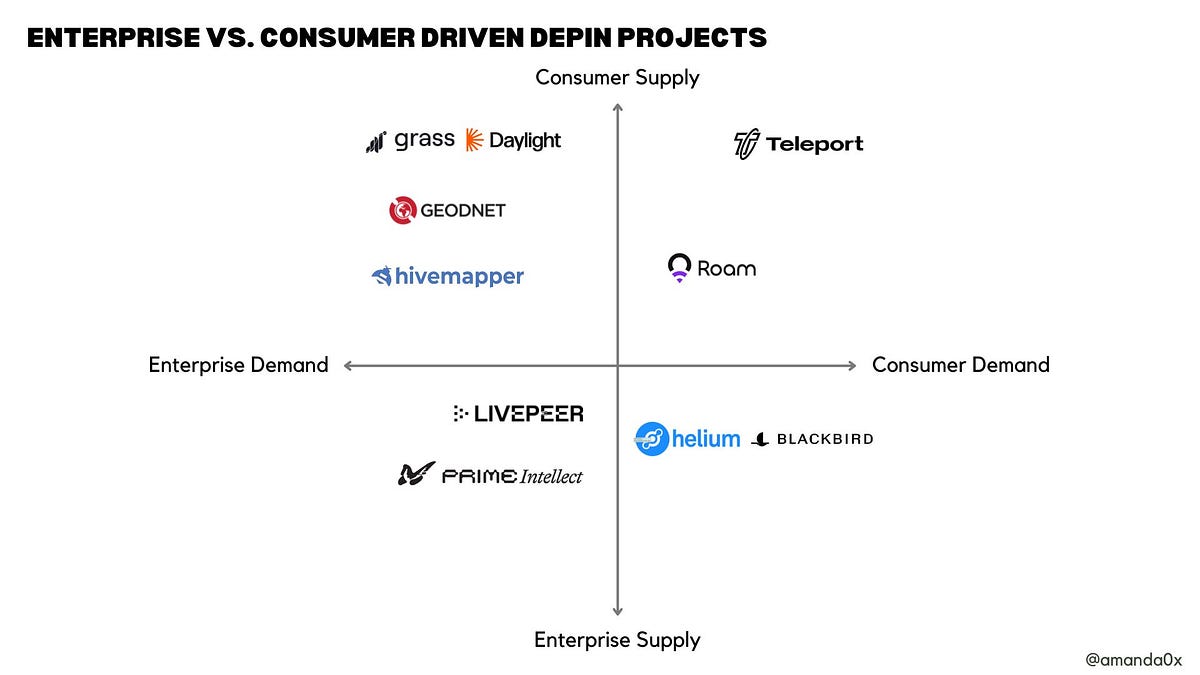

Consumers play a crucial role in the DePIN ecosystem, acting as the supply backbone for various networks in exchange for token rewards. These networks can be categorized into physical resource networks, which incentivize consumers to contribute to real-world infrastructure, and digital resource networks, where consumers help build virtual infrastructure. For instance, decentralized energy networks rely on consumers to connect distributed energy resources like solar panels, while decentralized mapping projects leverage consumer-grade hardware to gather location data. Additionally, consumers can contribute their computing power and bandwidth to decentralized compute platforms, enhancing the capabilities of AI and machine learning applications.

As DePIN projects evolve, they are increasingly generating revenue and attracting consumer demand. By tapping into consumer marketplaces and offering direct-to-consumer products, these projects can streamline customer acquisition and enhance user engagement. The DePIN model not only incentivizes new consumer behaviors but also accelerates the adoption of existing ones, particularly in the energy sector. As these networks grow, they unlock new applications and services, creating a flywheel effect that attracts developers and increases consumer adoption. Overall, the intersection of consumers and DePIN is paving the way for innovative solutions and a more decentralized future.

4 months ago

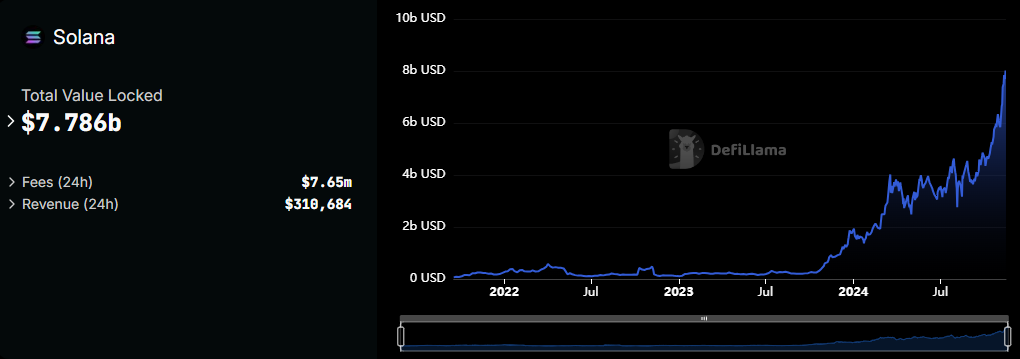

Solana Surges to 111% of Ethereum's Economic Value Amid DeFi Growth

In October, Solana's real economic value (REV) reached an impressive 111% of Ethereum's, driven by significant growth in decentralized finance (DeFi) and innovative projects such as Hivemapper and Helium. The price of Solana (SOL) surged by 36% recently, hitting $213, but it now faces a crucial challenge at the $221 resistance level. Despite strong network activity and a notable increase in staking, concerns linger about the sustainability of this momentum. The decentralized exchange (DEX) volumes have also seen a remarkable rise, with daily trading exceeding $5 billion for three consecutive days last week, totaling $16 billion from November 10 to 15, primarily driven by Raydium and Orca.

Staking activity has emerged as a key factor in bolstering investor confidence, with over $8 billion worth of SOL staked, which helps alleviate selling pressure and enhances price stability. This represents one of Solana's strongest metrics during its current rally. Technical indicators support a positive outlook, as the average directional index (ADX) for SOL stands at 32, indicating a strong trend. However, the inability to breach the $221 barrier could result in a price range between $201 and $221 in the short term, with potential pullbacks signaling a reversal of the bullish trend.

Solana's DeFi ecosystem continues to thrive, with meme coin trading contributing to a daily volume of $1 billion, showcasing its growing appeal among retail traders. The network's impact extends beyond DeFi, with projects like Hivemapper mapping a significant portion of global roads and Helium expanding its device network. With robust staking, increasing transaction volumes, and strong technical indicators, Solana is poised for further growth. However, breaking the $221 resistance is critical for unlocking greater potential, with medium-term targets projected between $400 and $500, supported by a bullish cup-and-handle formation on its chart.

4 months ago

The Impact of Upbit Listing Success Rate and UDC Conference Overview

The Impact of Upbit Listing Success Rate and UDC Conference Overview

Recently, with the market gaining strength, the wealth effect of new listings on Upbit has become more prominent. Tokens like AGLD saw a staggering 150% increase on the first day, while DRIFT surged by 190%. Tokens like SAFE, CARV, and PEPE also experienced a 100% increase. The Formula team made a fortune through news trading, showcasing the potential for wealth creation on Upbit. How can we seize the wealth wave of new listings on Upbit? The UDC conference serves as a barometer for Upbit listings. The listing success rate from 2018 to 2023 stands at 76%. On November 14th, the UDC conference was held as scheduled, offering a glimpse into the participating projects. UDC, organized by Dunamu since 2018, is a representative blockchain conference in South Korea aimed at promoting industry development, ecosystem growth, and adoption. This year's theme, 'Blockchain: Driving Real-World Change,' delves into how blockchain is expanding into various industries and bringing about real-world transformations. According to Layerggofficial data, from 2018 to 2023, approximately 66 projects participated in UDC, with 37 projects already listed on KRW Fair before UDC. Among the remaining 29 projects, 13 were listed in KRW form after UDC (44.8%). The significance of the UDC conference and the wealth effect on Upbit stem from various factors.

UDC's Importance and Upbit's Wealth Effect

Upbit, as South Korea's largest exchange, holds a leading position in the Korean market in terms of trading volume and user numbers, commanding around 73% of the market share. Korean investors can directly purchase cryptocurrencies using the Korean Won (KRW), leading to significant wealth effects. The convenience of deposits and substantial wealth effects have propelled cryptocurrency trading volume in Korea beyond the country's stock market. This dynamic ensures strong buying interest for new tokens listed on Upbit. The UDC conference, organized by Dunamo, Upbit's parent company, though slightly smaller in terms of timing and participation compared to events like KBW, holds undeniable importance. Projects like ZRO, MNT, and STG, which participated in last year's conference, were listed on Upbit this year, indicating the enduring influence of the conference. Data source: [Layerggofficial](https://x.com/layerggofficial/status/1714145904943587774?s=46)

UDC 2024 Conference Projects

The UDC conference for this year has already taken place, with projects like Axelar, Taiko, Zetachain, Mantle, and Cyber already listed on Upbit. As of the conference, there are still 11 projects yet to be listed on Upbit or to have KRW trading pairs. Projects awaiting listing include SLP, HNT, GALA, NFT, and ROSE. Projects already listed with BTC pairs but without KRW pairs include MKR, YGG, IOTX, and Cyber. Projects that have not launched tokens but participated in UDC include Linea and Magic Eden. Compliance and AI remain strong narratives in line with this year's UDC theme. Despite Oasis Network not participating in this year's UDC, leveraging AI narratives, ROSE saw a surge on November 5th. Additionally, South Korea's high interest in NFTs and the gaming market suggests that Magic Eden's token has a high probability of being listed on Upbit. Apart from the forward-looking impact of the UDC conference, another South Korean exchange, Bithumb, also has relevance to Upbit listings. Both exchanges tend to list coins in clusters based on narratives, such as introducing AI tokens simultaneously at the beginning of the year or focusing on Memecoins currently. To protect investors, Korean exchanges typically avoid small, new coins with short market history, opting for older coins with stable market capitalization and prices.

5 months ago

Understanding Helium Mining: A New Era in Wireless Connectivity

Helium mining is a pioneering mechanism that underpins the Helium network, designed to provide global wireless connectivity for Internet-of-Things (IoT) devices. By running a hotspot, miners contribute to a decentralized infrastructure known as "The People’s Network," which facilitates low-powered, long-range wireless communication. This innovative use of blockchain technology rewards participants with Helium (HNT) tokens, effectively reducing reliance on traditional telecom providers and lowering IoT connectivity costs. The Helium network, which began development in 2013 and rebranded to Nova Labs in 2022, showcases the versatility of blockchain technology, expanding its applications beyond financial transactions into real-world infrastructure.

The mining process utilizes a proof-of-coverage (PoC) consensus mechanism, which ensures that hotspots are providing legitimate wireless coverage while rewarding them with HNT tokens. Miners operate specialized hardware that functions as both a wireless gateway and a blockchain node, validating transactions and extending network coverage. This decentralized approach contrasts sharply with traditional cellular networks, which rely on large, intrusive cell towers. Helium hotspots, powered by the Low Power Wide Area Networking Protocol (LoRaWAN), enable a wide range of applications, from smart agriculture to asset tracking, highlighting the potential of decentralized physical infrastructure networks (DePINs).

The profitability of Helium mining can vary significantly based on location, competition, and the number of connected IoT devices. While urban areas may face saturation, rural locations often present profitable opportunities due to lower competition. The transition to 5G technology introduces new earning potentials but requires specialized equipment. As demand for IoT connectivity grows, so too does the potential for increased miner rewards. Despite the inherent volatility of cryptocurrency markets, the steady growth in network usage and market capitalization suggests a promising outlook for Helium mining profitability in the coming years.

5 months ago

Helium's HNT Token Shows Strong Bullish Momentum with Potential for New Highs

As the cryptocurrency market shows signs of recovery, Helium's HNT token is experiencing a significant bullish resurgence. The price has made a swift V-shaped reversal, recently crossing above the $6.50 mark. This upward movement has resulted in a weekly surge of approximately 20%, positioning Helium for a potential breakout rally that could lead to a new 52-week high. Market analysts are now questioning whether this uptrend will push HNT above the psychological $10 threshold, which would mark a significant milestone for the token.

In analyzing HNT's price action, the daily chart reveals a bullish comeback from the 50% Fibonacci level, coinciding with the 200-day Simple Moving Average (SMA). This reversal is characterized by a bounce from the $5.52 support level, which has allowed the price to exceed the 61.80% Fibonacci level at $6.365. Currently, HNT is trading at $6.66, reflecting an intraday increase of 7.36%. The formation of four out of five bullish candles indicates a strong recovery, although the price has yet to break the lower-high formation trend. A successful jump above the $7.78 mark, or the 78.60% Fibonacci level, could signal a significant shift in the price trend, enhancing the likelihood of reaching a new 52-week high.

Looking ahead, the technical indicators suggest a bullish outlook for Helium. The consolidation between the 50-day and 200-day SMA lines indicates that a breakout above the upper resistance could amplify the trend momentum. Additionally, the MACD is nearing a bullish crossover due to increased buying pressure. If the bullish trend persists, price targets based on Fibonacci retracement levels are set at $10.05, with further potential highs of $13.91 and $21. Conversely, critical support levels are identified at $6.36 and the psychological $6 mark, which will be essential for maintaining upward momentum in the coming months.

5 months ago

Helium and Xnet Shift Focus to Wi-Fi in Decentralized Wireless Networks

In a significant shift within the decentralized wireless network market, Helium and Xnet are now prioritizing Wi-Fi connections over the previously favored 3.5GHz CBRS spectrum band. This change is largely driven by the challenges associated with CBRS, including interference and poor user experience. Mario Di Dio, general manager of Nova Labs' Helium network, emphasized that Wi-Fi, particularly with Passpoint technology, offers a more mature and easier deployment option. This technology, which streamlines Wi-Fi connectivity, has gained widespread support across various devices, making it a more attractive alternative for decentralized network operators.

Both Helium and Xnet have transitioned from encouraging the deployment of costly CBRS radios to promoting the installation of Wi-Fi hotspots, which are significantly less expensive. While the coverage area of Wi-Fi hotspots is generally smaller compared to CBRS sites, this strategy has led to major offloading agreements with prominent wireless network operators. Helium has secured deals with two of the three major 5G operators in the U.S., while Xnet claims to have an agreement with AT&T. These partnerships allow both companies to offload network traffic onto their respective sites, rewarding hotspot operators with cryptocurrency tokens based on the amount of data offloaded.

The evolution from decentralized wireless (DeWi) to decentralized physical infrastructure networks (DePIN) reflects a broader trend where companies are leveraging decentralized models across various sectors, including energy and mapping. Helium, a pioneer in this space, has expanded its offerings to include a mobile virtual network operator (MVNO) service, attracting around 100,000 customers. As the debate over the utilization of the CBRS spectrum continues, the shift towards Wi-Fi may reshape the landscape of decentralized networks, highlighting the growing importance of flexible and accessible wireless solutions in the telecommunications industry.

Signup for latest DePIN news and updates