Solana Surges to 111% of Ethereum's Economic Value Amid DeFi Growth

In October, Solana’s real economic value (REV) reached an impressive 111% of Ethereum’s, driven by significant growth in decentralized finance (DeFi) and innovative projects such as Hivemapper and Helium. The price of Solana (SOL) surged by 36% recently, hitting $213, but it now faces a crucial challenge at the $221 resistance level. Despite strong network activity and a notable increase in staking, concerns linger about the sustainability of this momentum. The decentralized exchange (DEX) volumes have also seen a remarkable rise, with daily trading exceeding $5 billion for three consecutive days last week, totaling $16 billion from November 10 to 15, primarily driven by Raydium and Orca.

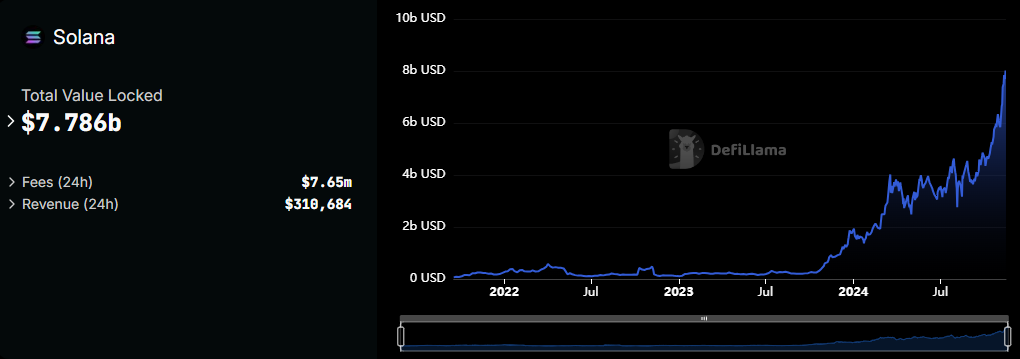

Staking activity has emerged as a key factor in bolstering investor confidence, with over $8 billion worth of SOL staked, which helps alleviate selling pressure and enhances price stability. This represents one of Solana’s strongest metrics during its current rally. Technical indicators support a positive outlook, as the average directional index (ADX) for SOL stands at 32, indicating a strong trend. However, the inability to breach the $221 barrier could result in a price range between $201 and $221 in the short term, with potential pullbacks signaling a reversal of the bullish trend.

Solana’s DeFi ecosystem continues to thrive, with meme coin trading contributing to a daily volume of $1 billion, showcasing its growing appeal among retail traders. The network’s impact extends beyond DeFi, with projects like Hivemapper mapping a significant portion of global roads and Helium expanding its device network. With robust staking, increasing transaction volumes, and strong technical indicators, Solana is poised for further growth. However, breaking the $221 resistance is critical for unlocking greater potential, with medium-term targets projected between $400 and $500, supported by a bullish cup-and-handle formation on its chart.

Related News