Latest Helium News

2 days ago

Decentralizing Telecom Infrastructure: A Win-Win for Small Businesses and Telecom Giants

In a recent interview at Consensus 2025 in Toronto, Frank Mong, the COO of Nova Labs, emphasized the financial benefits of decentralizing telecommunication infrastructure for both small businesses and large telecom corporations. He highlighted that local operators, such as bars and restaurants, can generate revenue by hosting wireless hotspots, thereby expanding network coverage. This decentralized approach allows significant cost savings for telecom giants, who can utilize the Helium Network's telemetry to enhance their services in areas that typically lack coverage, known as dead zones.

Mong pointed out the high costs associated with traditional telecom infrastructure, noting that establishing a single 5G tower can cost around $300,000. Instead of burdening consumers with expensive phone plans, he proposed a model where individuals with Wi-Fi networks can share their connections securely, providing valuable data to major companies like AT&T. This innovative use of decentralized physical infrastructure networks exemplifies how blockchain technology can enhance resilience against outages and disruptions while delivering real-world value.

In addition to these insights, Nova Labs has been actively forming partnerships with telecom companies to improve network coverage. Notably, in January 2024, they collaborated with Telefónica in Latin America, and more recently, in April 2025, they partnered with AT&T to facilitate automatic access for users within the Helium Network's coverage area. With over 95,000 mobile hotspots in the U.S. and more than 284,000 active IoT hotspots globally, Mong believes that the success seen in the U.S. and Mexico should be replicated worldwide as Nova Labs continues to expand its reach through strategic partnerships.

7 days ago

Grass ($GRASS) Faces Correction After 500% Surge: Future Price Predictions

Grass ($GRASS), a decentralized project built on the Solana blockchain, has experienced an 8% decline in value over the past 24 hours, following an impressive 500% surge earlier this month. This downturn raises questions about the sustainability of its recent growth, particularly as it aligns with a broader market correction. Despite this setback, $GRASS has managed to retain a 14-day gain of approximately 13%. The token, which launched in October 2024, has seen significant price fluctuations, reaching an all-time high of $3.90 before settling around $1.88, placing it among the top 123 cryptocurrencies by market capitalization at roughly $460 million.

Grass distinguishes itself by merging Decentralized Physical Infrastructure Network (DePIN) elements with Artificial Intelligence (AI) functionalities. Users who install the Grass browser app can share their excess internet bandwidth to train AI models, earning rewards in the process. This innovative model has led to substantial growth, with the user base expanding from 200,000 to over 3 million between Q4 2024 and early 2025. The platform's capabilities were further enhanced by the Sion Upgrade, which significantly improved its ability to scrape and process multimodal web content, achieving daily data collection rates that rival those of major tech companies.

Despite the recent dip in activity, with daily data scraping falling to around 759,000 TB, Grass remains a formidable player in the DePIN space, second only to Helium on Solana. The project has secured listings on major exchanges, and many traders believe it is currently undervalued, with bullish predictions suggesting a market cap of $1 billion and a potential price target exceeding $4 by year-end. Technical analysis indicates that while the asset has faced resistance, a rebound from current support levels could signal a new upward trend, although a drop below key moving averages might lead to further declines.

7 days ago

Helium Foundation Commits $50 Million to Expand Decentralized Wireless Coverage

The Helium Foundation has announced a significant commitment of $50 million in grant funding aimed at expanding the Helium Network's coverage and accessibility. This initiative is part of a broader strategy to enhance decentralized wireless services, which have already connected over one million users daily. The foundation's goal is to support deployers who contribute to the network's growth while reducing the costs associated with deploying new wireless coverage. With partnerships established with major carriers like AT&T and Telefónica’s Movistar, the Helium Network is poised to make a substantial social impact by providing affordable connectivity to underserved areas.

As the demand for Helium Network coverage continues to rise, the foundation is focusing on empowering local communities and individuals to deploy wireless coverage in their neighborhoods and businesses. This initiative is not only about enhancing connectivity but also about creating economic opportunities for those who participate as network deployers. The foundation's commitment includes funding for education, case studies, and strategic initiatives that promote decentralized wireless technology, ensuring that a diverse range of stakeholders can benefit from its advantages.

The grant program will kick off in New York City and is set to expand across the United States and Mexico through 2025. The Helium Foundation aims to onboard more mobile service providers and offload partners globally, reinforcing its mission to support decentralized wireless growth. By investing in innovative projects and educational efforts, the foundation seeks to advocate for the broader adoption of decentralized wireless, showcasing its potential as a transformative use case for cryptocurrency and technology in general. The future of Helium looks promising as it strives to reshape global connectivity and empower communities worldwide.

11 days ago

Amp and Aethir Shine Amidst Crypto Market Cooling

In a cooling crypto market, Amp (AMP) and Aethir (ATH) have emerged as standout performers, each experiencing a notable 16% increase in value. Amp is currently valued at $0.0051, buoyed by strong bullish momentum supported by key Exponential Moving Averages (EMAs) and favorable trading signals from indicators like MACD and RSI, despite warnings of overbought conditions. Meanwhile, Aethir, which focuses on AI-driven blockchain solutions, has surged to $0.052, breaking past significant resistance levels and maintaining bullish optimism, although the overbought RSI suggests that traders should remain vigilant.

The divergence in the crypto market is evident as Helium (HNT) faces downward pressure, trading at $4.00 and struggling below the critical 200-day EMA. This situation poses a risk of further declines if it breaches the 100-day EMA support at $3.83. The contrasting trajectories of Amp and Aethir against Helium highlight the persistent volatility and innovation within the digital asset market, prompting traders to balance ambition with risk management strategies.

As traders navigate these turbulent waters, the resilience of Amp and Aethir underscores the potential for growth even amid market stagnation. Investors are encouraged to monitor key technical indicators closely, particularly EMAs and RSI levels, to identify optimal entry points and manage risks effectively. The ongoing developments in these projects reflect the dynamic nature of the cryptocurrency landscape, where innovation continues to drive interest and investment opportunities.

11 days ago

Helium: Revolutionizing Telecom with Decentralized Networks

Helium is making waves in the telecom industry by leveraging cryptocurrency to build what could be the most disruptive network in America. Originally starting as an Internet of Things (IoT) initiative, Helium has transformed into the world’s largest decentralized wireless network. With the support of the Decentralized Physical Infrastructure Network (DePIN) movement, Helium is redefining how infrastructure is constructed. Abhay Kumar, Helium's Protocol Lead, emphasized the company's mission: to create wireless infrastructure that fosters innovative business models. This evolution has allowed Helium to expand its services to include both IoT and 5G mobile networks, solidifying its position in the DePIN landscape.

The transition from connecting devices to connecting people has been pivotal for Helium. The launch of Helium Mobile, a new carrier, exemplifies this shift. In the U.S., users can access a free cell phone plan or opt for a limited plan at just $15 per month. Kumar attributes this affordability to Helium's unique protocol, which significantly reduces bandwidth costs for carriers. By utilizing the Helium network, carriers pay only 50 cents per gigabyte, a stark contrast to traditional pricing models. This cost efficiency is largely due to the DePIN model, which incentivizes individuals and businesses to install wireless nodes, such as 5G radios, in exchange for cryptocurrency rewards.

Helium's decentralized infrastructure approach has emerged as a leading example of the potential of DePIN. Kumar noted the company's fortunate timing in establishing this model before it became widely recognized. By allowing local shop owners to contribute to the network, Helium not only enhances customer satisfaction but also enables carriers to extend their reach. The collaborative nature of this model benefits all parties involved, showcasing how decentralized networks can revolutionize the telecom sector and create sustainable business practices.

13 days ago

Exploring the Investment Potential of Decentralized Physical Infrastructure Networks (DePIN)

The recent analysis of Decentralized Physical Infrastructure Networks (DePIN) highlights its potential as a significant investment track in the cryptocurrency landscape. DePIN, which aims to decentralize the infrastructure of the physical world, is gaining traction alongside AI as a promising direction for investment. However, the sector currently lacks a leading project to catalyze its growth, with Helium being the most recognized name, albeit predating the DePIN concept. The analysis suggests that DePIN could yield substantial returns in the next 1-3 years, as it addresses real-world needs through decentralized solutions, such as reducing costs in telecommunications and AI data acquisition.

The investment rationale for DePIN is grounded in its ability to optimize traditional infrastructure models. For instance, in the telecommunications sector, traditional operators face exorbitant costs for spectrum licenses and base station deployments. In contrast, Helium Mobile allows users to become micro-operators by purchasing affordable hotspot devices, significantly lowering deployment costs. Similarly, in the AI domain, projects like Grass leverage distributed web scraping to reduce data acquisition expenses while ensuring compliance and diversity. These examples illustrate how DePIN can outperform conventional methods, making it an attractive investment opportunity.

Moreover, DePIN presents a unique intersection of infrastructure and consumer needs, addressing the challenges faced by both sectors. High-quality DePIN projects exhibit strong product-market fit and revenue generation, making them less susceptible to market volatility. As demonstrated by Helium's competitive pricing and Grass's user-friendly model, DePIN can effectively capture user interest and mindshare. While the path to widespread adoption may be gradual, the potential for DePIN to disrupt traditional industries and create sustainable value through innovative token economies is significant, positioning it as a focal point for investors looking ahead to 2025.

24 days ago

Exploring the Potential of DEPIN in Web3

In the rapidly evolving landscape of Web3, DEPIN, or Decentralized Physical Infrastructure Networks, is gaining significant attention. This innovative concept leverages the principles of decentralization to transform fragmented resources into valuable services. Amira Valliani, head of DEPIN at the Solana Foundation, emphasizes that DEPIN enables individuals to contribute their idle resources, such as WiFi bandwidth or data collection capabilities, to create a collaborative infrastructure. Projects like HiveMapper and Helium exemplify this model, allowing users to earn tokens by sharing their resources, thereby democratizing access to essential services that were previously dominated by large corporations.

The relationship between DEPIN and artificial intelligence (AI) is particularly noteworthy. As AI technology continues to advance, the demand for real-world data is skyrocketing. DEPIN serves as a vital data collection network that can provide the necessary information for AI applications, such as self-driving cars and delivery robots. By utilizing decentralized networks, DEPIN can gather data more efficiently and cost-effectively than traditional methods. This synergy between DEPIN and AI not only enhances the capabilities of AI systems but also opens new avenues for decentralized AI projects, challenging the dominance of major tech companies.

Looking ahead, Valliani predicts that DEPIN could evolve into a trillion-dollar industry, driven by the maturation of development tools, the increasing demand for real-world data due to AI advancements, and the influx of practical entrepreneurs into the Web3 space. As DEPIN lowers the barriers to entry for individuals to participate in infrastructure development, it creates new job opportunities and empowers ordinary people to engage in the digital economy. For those who missed the early days of Bitcoin and Ethereum, DEPIN presents a promising opportunity to get involved in the next wave of technological innovation.

25 days ago

Solana Emerges as Leader in DePIN Projects: A Comprehensive Analysis

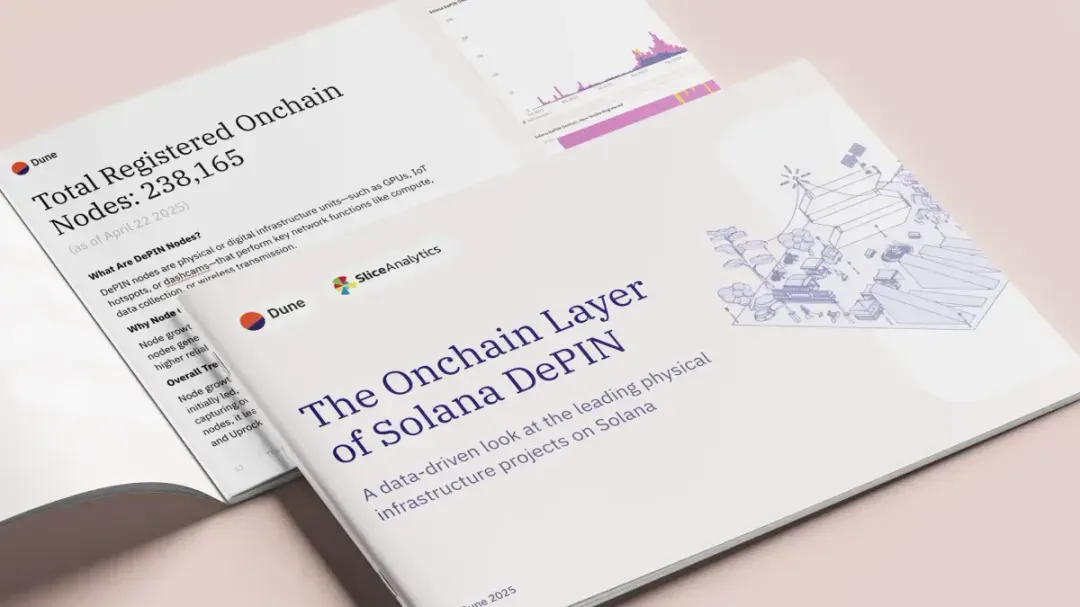

The latest research report from Dune and Slice Analytics presents a comprehensive analysis of the Decentralized Physical Infrastructure Network (DePIN) projects on Solana, highlighting their development status, market performance, and on-chain data. DePIN is emerging as a transformative model that utilizes cryptocurrency incentives to operate real-world infrastructure, such as shared GPUs and telecommunications networks. Solana has positioned itself as a leading platform for these projects due to its high throughput and low transaction costs, making it an ideal environment for the growth of DePIN applications. As of April 2025, the total market value of DePIN projects on Solana reached $3.25 billion, surpassing other blockchain platforms significantly.

The report categorizes DePIN projects into five main segments: Compute, Wireless, Sensor, Server, and AI, with the Compute category dominating the market at 71.2%. Projects like Render and Helium are leading the way, providing decentralized processing power and wireless connectivity, respectively. The growth of registered on-chain nodes for DePIN projects on Solana has also been notable, reaching 238,165 by April 2025. Helium, in particular, has seen rapid growth in its mobile user base and node deployment, while Render and Hivemapper continue to expand their contributions to the ecosystem.

As the cryptocurrency industry matures, on-chain revenue has become a crucial metric for evaluating the sustainability of these projects. By April 2025, the total on-chain revenue for DePIN projects on Solana reached $5.98 million, indicating a strong product-market fit. Helium emerged as the top earner, while Render and Hivemapper also demonstrated significant revenue generation. The report underscores Solana's dominance in the DePIN space and emphasizes the importance of transparency in tracking on-chain activities, which remains a challenge due to the reliance on off-chain hardware and third-party integrations.

a month ago

The Rise of DePIN: Innovations and Challenges in 2024

In 2024, the DePIN sector is witnessing a significant surge in interest, as highlighted by Messari's State of DePIN 2024 report. Over 13 million devices are actively participating in various DePIN networks daily, with the total market capitalization of related tokens exceeding $50 billion. Despite this growth, the sector's current scale is modest compared to its potential trillion-dollar market. The report notes that 20 DePIN projects have surpassed 100,000 active nodes, with five exceeding one million. However, these projects face ongoing challenges in demand generation and monetization, which are critical for sustainable growth.

Helium, a pioneer in the DePIN space, continues to enhance its network through upgrades and expansions. Following its migration to the Solana chain, Helium saw a rise in IoT hotspots to 32,900 and 5G mobile hotspots to 24,800 by Q4 2024. The partnership with traditional telecom operators has significantly improved network utilization, with Helium offloading over 576 TB of data traffic, marking a 555% increase quarter-over-quarter. Despite these advancements, the DePIN sector struggles with high hardware costs, cold start challenges, node quality issues, and inadequate Sybil resistance mechanisms, which hinder its overall market performance.

Emerging projects like CyberCharge are exploring innovative solutions to address these challenges by lowering barriers to entry. CyberCharge has introduced a decentralized charging network with a Charge-to-Earn model, allowing users to earn crypto rewards through everyday charging activities. This approach not only makes participation accessible but also enhances user engagement through interactive features. As the DePIN sector evolves, the focus on real-world applications and sustainable business models will be crucial for attracting users and fostering long-term demand. The future of DePIN looks promising, with the potential for significant growth as it integrates blockchain technology into everyday infrastructure.

a month ago

AT&T Partners with Helium to Enhance Decentralized Connectivity

AT&T has announced its first foray into decentralized physical infrastructure (DePIN) through a partnership with Helium, enabling customers to access a network of user-powered WiFi hotspots. This collaboration, revealed on April 24, is seen as a significant advancement in Helium's mission to provide affordable and accessible connectivity. Helium operates a decentralized wireless network where individuals deploy low-power devices called Hotspots, functioning as miniature cell towers and offering wireless coverage in exchange for token-based rewards. Currently, Helium boasts over 93,500 active Hotspots, primarily in the United States.

The partnership allows AT&T to leverage Helium's hotspot coverage via Passpoint integration, a WiFi authentication protocol that facilitates automatic and secure connections to participating hotspots. This integration enhances user connectivity, especially in areas with weak mobile signals, while allowing AT&T to expand its service footprint without the need for additional infrastructure. For Helium, this partnership increases the utility of its network and raises its profile among mainstream users. Additionally, AT&T gains access to real-time network quality metrics, providing valuable insights into performance across decentralized nodes, a level of transparency often lacking in traditional infrastructure models.

This collaboration is a notable milestone for the DePIN movement, but it is not Helium's first engagement with the telecom sector. Previously, Helium partnered with Telefónica's Movistar in Mexico, integrating its network to support connectivity for over 2.3 million subscribers. Furthermore, Helium has been enhancing its technology stack to promote broader adoption, including a licensing program for hardware manufacturers. The launch of Helium Mobile's Zero Plan in February 2025, which offers free data and talk time by utilizing Helium's decentralized network alongside T-Mobile's 5G service, marks another significant step forward for the project.

Signup for latest DePIN news and updates