Latest DePIN Funding News

5 months ago

NVIDIA's Upcoming Earnings Could Impact AI Token Market

NVIDIA, a leading player in GPU technology, is set to announce its Q3 fiscal year 2024 earnings on November 20. This announcement is highly anticipated within the cryptocurrency market, particularly for AI-focused tokens such as Render (RENDER), Grass (GRASS), and PAAL AI. Render has recently undergone a migration and rebranding from Ethereum to Solana, positioning itself as a prominent AI coin. Currently trading at $7.67, RENDER has shown a 3.75% increase over the past week, indicating growing investor confidence. Analysts suggest that if NVIDIA's earnings exceed expectations, RENDER could potentially rise to $8.83, with a bullish scenario reaching $11.86. However, there are concerns about a possible 'sell the news' effect that could lead to a price drop to $5.47 if enthusiasm diminishes.

Grass (GRASS), another AI token, has faced challenges, declining by 24.31% in the last week and currently trading at $2.36. It is positioned within a descending wedge pattern, which typically signals a potential breakout. The support level for GRASS is at $2.30, with resistance levels at $3.29 and $3.91. The token's RSI indicates oversold conditions, but weak trading volume suggests limited buying pressure. A strong performance from NVIDIA could shift sentiment positively for GRASS, while disappointing earnings may exacerbate its downward trend.

PAAL AI has experienced a volatile week, currently trading at $0.1878 after a significant recovery of 25.20%. This follows a drastic drop of 70% due to concerns surrounding a proposed merger with the ASI Alliance. The merger announcement led to a rapid sell-off, driven by worries over the token conversion ratio and a lengthy vesting period. Transparency regarding the merger is crucial, as highlighted by industry figures. The performance of NVIDIA's stock could greatly influence PAAL AI's trajectory, with potential for a rally or further decline depending on market demand and investor sentiment.

5 months ago

io.net Partners with Zero 1 to Boost Decentralized AI Development

Decentralized Physical Infrastructure Network (DePIN) io.net is making strides in the decentralized AI (DeAI) sector by expanding its GPU Compute connection services to Zero 1 Labs. This collaboration aims to enhance the development of DeAI by providing Zero 1 with access to high-performance GPU compute power. The partnership is expected to facilitate the training of AI agents for Keymaker, Zero 1's open marketplace, thereby accelerating the overall development of decentralized AI applications. Developers and users on the Zero 1 platform will benefit from demand-based, cost-effective GPU computing, making it easier to utilize tools for building and deploying DeAI applications.

Zero 1 operates as a proof of stake-based decentralized AI ecosystem, allowing innovators and developers to create optimized DeAI applications with Fully Homomorphic Encryption (FHE). This ensures secure data governance and privacy at the AI computation level. The partnership with io.net will enhance Zero 1's computing capabilities, particularly for Keymaker, which serves as a multimodal AI marketplace. With over 100 DeAI tools available, the marketplace is designed to facilitate the creation and discoverability of DeAI applications, catering to developers aiming to build effective on-chain AI agents.

In addition to GPU compute services, io.net and Zero 1 Labs are committed to fostering innovation through joint initiatives, including hackathons and bounty programs. These community-driven events will allow developers to collaborate and share their experiences, enriching the DeAI ecosystem. The strategic exchange of resources between the two entities will enable projects within Zero 1's ecosystem to access advanced AI expertise and high-performance resources from io.net. Ultimately, this partnership is poised to enhance Zero 1's market share in the DeAI developer landscape while reducing infrastructure costs, thereby accelerating innovation in the decentralized AI space.

5 months ago

The Graph (GRT) Price Analysis: Bullish Momentum and Key Resistance Levels

The Graph (GRT) has recently experienced a significant price movement, breaking out of a falling wedge pattern and reclaiming the crucial $0.20 psychological mark. Currently trading at $0.2106, the GRT price has shown a 3.48% intraday pullback after a rally that began at $0.1274. This upward momentum is indicative of a broader market trend, suggesting that GRT may be on the verge of a substantial bullish phase. As the price approaches a critical juncture, traders are left wondering whether this retest will lead to a bounce-back rally that could push GRT past the $0.30 mark.

The daily chart analysis reveals that GRT's price action has not only surpassed the overhead resistance trendline but has also crossed above the 200-day exponential moving average (EMA), signaling a potential change in trend character. The breakout above the 23.60% Fibonacci level further reinforces the bullish sentiment. Following a notable 13.74% increase, the price action is currently in a retest phase of this Fibonacci level, with expectations of a continuation towards the next resistance at $0.2521, which corresponds to the 38.20% Fibonacci level.

Technical indicators support the bullish outlook for GRT. The 50-day EMA is poised to cross above the 100-day EMA, hinting at a possible golden crossover on the daily chart. Additionally, the MACD indicator shows a gradual bullish trend, with positive histograms suggesting sustained upward momentum. If the bullish trend continues, GRT may challenge higher Fibonacci levels at $0.290 and $0.3292 by the end of the month. However, a failed retest could lead to a decline towards $0.18 or lower, emphasizing the importance of monitoring these levels closely.

5 months ago

Surge in Liquid Staking Tokens Highlights Growing Market Dynamics

The recent surge in price volatility among Liquid Staking Tokens (LSTs) indicates a burgeoning interest in active trading and speculative opportunities within the cryptocurrency market. In early 2024, the token $LDO saw a significant price increase, capturing the attention of both traders and investors. In contrast, $ANKR exhibited a consistent upward trend, showcasing the diverse strategies that investors are employing as they navigate the evolving landscape of LSTs. These developments highlight the dynamic market forces that are influencing the performance of individual tokens.

Moreover, the Total Market Capitalization of Solana-based Liquid Staking Tokens has reached an impressive all-time high of $7.40 billion, reflecting robust demand for these digital assets. Among the leading tokens in terms of market share, $JitoSOL stands out with a dominant 43%, followed by $mSOL at 16.3%, and $jupSOL at 12.5%. This remarkable growth in Solana's LST ecosystem underscores the increasing adoption of staking solutions that not only enhance capital efficiency but also provide flexibility for investors. By allowing token holders to stake their assets while maintaining liquidity, LSTs present a compelling alternative to traditional staking methods.

The success of these tokens not only underscores their utility within the DeFi ecosystem but also emphasizes the broader market dynamics where speculation and strategic investment are pivotal. As the LST sector continues to expand, it is poised to remain a focal point for innovation and investment within the cryptocurrency industry. Investors are encouraged to conduct thorough research before engaging in trading or investment activities, as the landscape remains highly volatile and subject to rapid changes.

5 months ago

Theta Labs Partners with Peking University to Advance AI Research

Theta Labs has made significant strides in the realm of AI and blockchain research by announcing Peking University as a new customer for its EdgeCloud AI platform. Peking University, a prestigious institution ranked among the top 10 globally in computer science, will utilize Theta's hybrid cloud GPU infrastructure to enhance its research capabilities. This collaboration is part of Theta's broader initiative to support advanced AI research across various academic institutions, including notable universities in the US and Korea, such as the University of Oregon and KAIST. The addition of corporate clients like Liner and Jamcoding further underscores Theta's growing influence in the AI sector.

Professor Zhen Xiao, a leading figure in distributed systems and AI at Peking University, has been pivotal in this partnership. With a Ph.D. from Cornell University and a robust publication record, Professor Xiao's research spans multiple domains, including deep learning and blockchain. His involvement with Theta began in 2022 when he joined the Theta Advisory Board, contributing to the development of the EdgeCloud platform. The collaboration has already yielded several joint research papers presented at prestigious conferences, showcasing advancements in adaptive defense mechanisms for AI models and scalable blockchain frameworks.

The integration of EdgeCloud's hybrid cloud GPU infrastructure is set to revolutionize AI research at Peking University. Professor Xiao expressed enthusiasm about the potential of EdgeCloud to facilitate large-scale distributed AI projects, stating that it represents one of the most complex hybrid GPU systems he has encountered. This partnership not only enhances research capabilities at Peking University but also positions Theta as a leader in decentralized GPU platforms for academia in Asia, with aspirations for global expansion. The future of AI innovation is likely to be driven by infrastructure companies like Theta that effectively harness distributed computation and GPU resources.

5 months ago

Akash Network (AKT) Poised for New Highs Amid Bullish Momentum

The Akash Network (AKT) is currently making headlines as it approaches a significant milestone in the cryptocurrency market. Trading at around $4, AKT is nearing a billion-dollar market cap with a current valuation of $994 million. Over the past week, the altcoin has experienced a remarkable surge of nearly 50%, igniting discussions about its potential to reach a new 52-week high of $8.31. Analysts are closely monitoring the price action, particularly after a notable breakout from a falling wedge pattern, which has resulted in a 100% return from its previous low of $2.

Technical indicators suggest a strong bullish momentum for AKT. The price has surpassed the 50% Fibonacci retracement level at $3.60 and is currently trading above the 200-day exponential moving average (EMA). This bullish trend is further supported by the potential for a golden crossover between the 200-day EMA and the 50-day EMA. Recent trading sessions have shown a significant intraday surge of 22.73%, forming a bullish engulfing candle that indicates strong buying pressure. The MACD indicator also reflects this positive trend, marking the third consecutive week of bullish momentum, which raises expectations for continued upward movement.

Looking ahead, if the Akash Network maintains its current trajectory, analysts predict that the price could reach $6.19, paving the way for a potential breakthrough above the $6.85 mark. Fibonacci projections suggest that if this level is surpassed, AKT could aim for targets of $8.31 and even $12.09. While the bullish sentiment is strong, experts caution that minor corrections could occur, providing opportunities for consolidation before further upward movements. Overall, the Akash Network's future appears promising as it gains traction in the cryptocurrency space.

5 months ago

Exploring the Intersection of Cryptocurrency and Consumer AI

In recent discussions about the intersection of cryptocurrency and consumer artificial intelligence (AI), a notable trend has emerged highlighting the potential for collaboration between these two rapidly evolving technologies. Over the past year, interest in this intersection has surged, leading to numerous project launches aimed at leveraging AI's capabilities within the crypto space. While traditional consumer AI applications have become more intuitive and accessible, the crypto sector still grapples with the need for engaging consumer-facing applications that can effectively utilize blockchain technology. The current landscape presents a unique opportunity for developers to create innovative solutions that combine the strengths of both fields, particularly in areas like gaming, content generation, and personalized user experiences.

The traditional consumer AI market has seen significant growth, with content generation tools leading the charge. Reports indicate that these applications account for a substantial portion of the most visited consumer AI products. Notably, the recent a16z report and Y Combinator's latest cohort highlight the ongoing evolution of consumer AI, with many new projects emerging in categories such as productivity, gaming, and edtech. However, the crypto sector remains relatively underdeveloped in terms of consumer applications, with only a small fraction of projects effectively integrating AI and blockchain technology. This gap presents a ripe opportunity for builders to explore innovative applications that cater specifically to the needs of crypto users, enhancing their experience and engagement with digital assets.

As the landscape continues to evolve, the potential for AI to enhance crypto applications is becoming increasingly apparent. By harnessing AI's ability to personalize user interactions and streamline processes, developers can create compelling consumer applications that not only drive user engagement but also foster a deeper understanding of blockchain technology. The integration of AI into crypto projects could unlock new avenues for monetization, incentivization, and user participation, paving the way for a new wave of consumer applications that redefine how individuals interact with digital assets. As both technologies mature, the collaboration between crypto and consumer AI holds the promise of transforming the digital landscape, offering exciting opportunities for innovation and growth in the coming years.

5 months ago

U2U Network Partners with CoinList for DePIN Mainnet Campaign

The DePIN (Decentralized Physical Infrastructure Network) sector is currently witnessing a significant surge in interest, as evidenced by a recent poll conducted by CoinList. The poll asked users about their preferred project categories, with DePIN emerging as the top choice, highlighting its growing prominence in the blockchain space. In response to this trend, U2U Network, a Layer 1 blockchain focused on DePIN, has announced a collaboration with CoinList to launch an exclusive incentivized mainnet campaign. This initiative marks U2U Network as the first DePIN project to undertake a growth campaign on CoinList in the fourth quarter of 2024.

DePIN is recognized as a transformative technology that aims to decentralize critical infrastructure services such as computing, energy, and telecommunications. This approach not only enhances scalability and resilience but also offers cost-efficiency that surpasses traditional centralized systems. With a market capitalization exceeding $33.6 billion, the DePIN sector is attracting substantial investment from venture capitalists, signaling a robust confidence in its potential. According to a 2023 report by Messari, the market potential for DePIN is estimated at $2.2 trillion, with projections suggesting it could rise to $3.5 trillion by 2028. This growth is further underscored by leading DePIN projects securing over $1 billion in funding.

The U2U Incentivized Mainnet Saga Campaign, set to run from November 12, 2024, to February 10, 2025, aims to reward participants with $U2U tokens. Users can participate by bridging $USDT to receive $pUSDT, which can be staked in the U2U Incentivized Staking Pool, with a total reward pool of 10,000,000 $U2U tokens available. Beyond this collaboration with CoinList, U2U Network is also planning a campaign with Bitget, further expanding its influence in the DePIN ecosystem. As the anticipated listing approaches, U2U Network is poised to make significant contributions to the blockchain industry, fostering innovation and value for its users and the broader community.

5 months ago

Aptos, Bittensor, and BlockDAG: The Latest Movers in Cryptocurrency

In the ever-evolving world of cryptocurrency, Aptos (APT) has made headlines with a notable 21% surge, bouncing back after a significant drop earlier this month. This resurgence is attributed to the cryptocurrency reaching its Fibonacci retracement level, which has sparked renewed optimism among investors. The increase in active addresses, peaking at 1.27 million in June, further supports this bullish trend. As of now, Aptos is trading at approximately $9.38, with analysts suggesting a potential rise of another 19% to reclaim its October peak.

Meanwhile, Bittensor (TAO) has also experienced a remarkable 20% jump in a single day, driven by positive sentiment following recent elections. However, the cryptocurrency faces resistance as indicated by the Ichimoku Cloud, which could pose challenges for further upward movement. The Relative Strength Index (RSI) has surged into the overbought territory, suggesting that while there is strong buying interest, a correction may be imminent if the momentum does not sustain. Traders are closely monitoring TAO's short-term moving averages for signs of a trend reversal that could lead to higher resistance targets.

The standout performer in the current market is BlockDAG (BDAG), which has successfully raised over $122 million in its presale, attracting significant attention from investors. With over 15.3 billion coins sold at a price of $0.0234, early participants have already seen returns exceeding 2240%. BlockDAG’s innovative DAG-PoW technology positions it as a strong contender in the Layer-1 blockchain space, aiming for a target of $600 million. As the presale progresses, the urgency for investors to join increases, highlighting BlockDAG as a potential breakout altcoin that could redefine the market landscape.

5 months ago

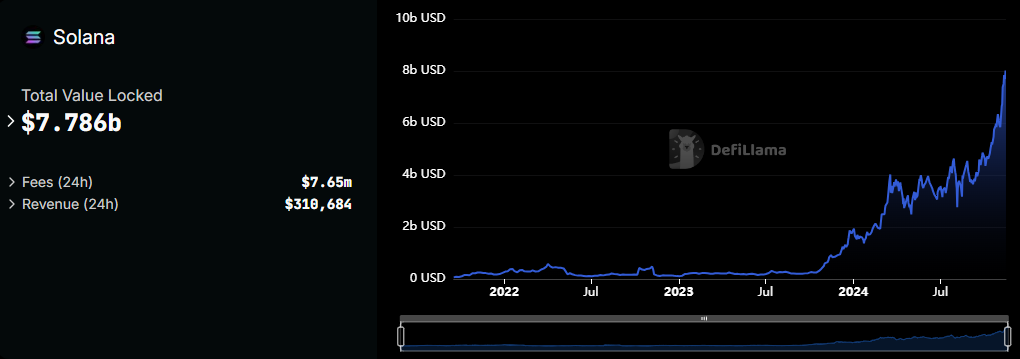

Solana Surges to 111% of Ethereum's Economic Value Amid DeFi Growth

In October, Solana's real economic value (REV) reached an impressive 111% of Ethereum's, driven by significant growth in decentralized finance (DeFi) and innovative projects such as Hivemapper and Helium. The price of Solana (SOL) surged by 36% recently, hitting $213, but it now faces a crucial challenge at the $221 resistance level. Despite strong network activity and a notable increase in staking, concerns linger about the sustainability of this momentum. The decentralized exchange (DEX) volumes have also seen a remarkable rise, with daily trading exceeding $5 billion for three consecutive days last week, totaling $16 billion from November 10 to 15, primarily driven by Raydium and Orca.

Staking activity has emerged as a key factor in bolstering investor confidence, with over $8 billion worth of SOL staked, which helps alleviate selling pressure and enhances price stability. This represents one of Solana's strongest metrics during its current rally. Technical indicators support a positive outlook, as the average directional index (ADX) for SOL stands at 32, indicating a strong trend. However, the inability to breach the $221 barrier could result in a price range between $201 and $221 in the short term, with potential pullbacks signaling a reversal of the bullish trend.

Solana's DeFi ecosystem continues to thrive, with meme coin trading contributing to a daily volume of $1 billion, showcasing its growing appeal among retail traders. The network's impact extends beyond DeFi, with projects like Hivemapper mapping a significant portion of global roads and Helium expanding its device network. With robust staking, increasing transaction volumes, and strong technical indicators, Solana is poised for further growth. However, breaking the $221 resistance is critical for unlocking greater potential, with medium-term targets projected between $400 and $500, supported by a bullish cup-and-handle formation on its chart.

Signup for latest DePIN news and updates