Latest DePIN Funding News

a day ago

Investors Eye GRASS and PI Crypto Tokens Amid Market Liquidations

Investors are currently focused on the GRASS and PI crypto tokens, which are making headlines due to their unique value propositions. The ongoing presale of Best Wallet has also garnered attention, raising over $12 million. In the past 24 hours, perpetual crypto exchanges like Binance, Bybit, and OKX have liquidated over $665 million in leveraged positions, affecting more than 153,000 traders. Despite this turmoil, many traders remain optimistic about GRASS and PI, viewing them as potential breakout tokens for Q2 2025. Notably, PI crypto has surged 80% since early April, while GRASS has increased by 140% since its all-time low in late October 2024.

GRASS is a decentralized layer-2 platform built on Solana, supported by prominent venture capitalists such as Polychain Capital and Tribe Capital. It allows users to monetize idle internet bandwidth, which is crucial for AI model training. The platform has facilitated the scraping of an impressive 57 million GB of public web data in Q1 2025 alone. Participants earn GRASS points, convertible to GRASS tokens, and the platform has seen a significant increase in node operators, indicating growing interest and adoption. Analysts are ranking GRASS among the top cryptocurrencies to explore, highlighting its potential in the AI and decentralized physical infrastructure network (DePIN) sectors.

On the other hand, Pi Network is making strides toward decentralization, having recently disabled its central node, thus empowering its community of over 60 million users. Despite facing skepticism regarding its legitimacy, Pi Network's mainnet launched in February 2025, and the price of PI crypto has fluctuated significantly since then. As both GRASS and PI continue to evolve, investors are advised to conduct thorough research before making investment decisions. Furthermore, the Best Wallet presale is generating excitement, with its features and security measures positioning it as a strong competitor in the crypto wallet space.

a day ago

Helium Foundation Commits $50 Million to Expand Decentralized Wireless Coverage

The Helium Foundation has announced a significant commitment of $50 million in grant funding aimed at expanding the Helium Network's coverage and accessibility. This initiative is part of a broader strategy to enhance decentralized wireless services, which have already connected over one million users daily. The foundation's goal is to support deployers who contribute to the network's growth while reducing the costs associated with deploying new wireless coverage. With partnerships established with major carriers like AT&T and Telefónica’s Movistar, the Helium Network is poised to make a substantial social impact by providing affordable connectivity to underserved areas.

As the demand for Helium Network coverage continues to rise, the foundation is focusing on empowering local communities and individuals to deploy wireless coverage in their neighborhoods and businesses. This initiative is not only about enhancing connectivity but also about creating economic opportunities for those who participate as network deployers. The foundation's commitment includes funding for education, case studies, and strategic initiatives that promote decentralized wireless technology, ensuring that a diverse range of stakeholders can benefit from its advantages.

The grant program will kick off in New York City and is set to expand across the United States and Mexico through 2025. The Helium Foundation aims to onboard more mobile service providers and offload partners globally, reinforcing its mission to support decentralized wireless growth. By investing in innovative projects and educational efforts, the foundation seeks to advocate for the broader adoption of decentralized wireless, showcasing its potential as a transformative use case for cryptocurrency and technology in general. The future of Helium looks promising as it strives to reshape global connectivity and empower communities worldwide.

a day ago

Grass ($GRASS) Faces Correction After 500% Surge: Future Price Predictions

Grass ($GRASS), a decentralized project built on the Solana blockchain, has experienced an 8% decline in value over the past 24 hours, following an impressive 500% surge earlier this month. This downturn raises questions about the sustainability of its recent growth, particularly as it aligns with a broader market correction. Despite this setback, $GRASS has managed to retain a 14-day gain of approximately 13%. The token, which launched in October 2024, has seen significant price fluctuations, reaching an all-time high of $3.90 before settling around $1.88, placing it among the top 123 cryptocurrencies by market capitalization at roughly $460 million.

Grass distinguishes itself by merging Decentralized Physical Infrastructure Network (DePIN) elements with Artificial Intelligence (AI) functionalities. Users who install the Grass browser app can share their excess internet bandwidth to train AI models, earning rewards in the process. This innovative model has led to substantial growth, with the user base expanding from 200,000 to over 3 million between Q4 2024 and early 2025. The platform's capabilities were further enhanced by the Sion Upgrade, which significantly improved its ability to scrape and process multimodal web content, achieving daily data collection rates that rival those of major tech companies.

Despite the recent dip in activity, with daily data scraping falling to around 759,000 TB, Grass remains a formidable player in the DePIN space, second only to Helium on Solana. The project has secured listings on major exchanges, and many traders believe it is currently undervalued, with bullish predictions suggesting a market cap of $1 billion and a potential price target exceeding $4 by year-end. Technical analysis indicates that while the asset has faced resistance, a rebound from current support levels could signal a new upward trend, although a drop below key moving averages might lead to further declines.

a day ago

Navigating the Challenges of DePIN: Insights from DIMO and CyberCharge

As decentralized physical infrastructure networks (DePIN) continue to develop, a significant issue has emerged: while the networks are built, the actual user engagement remains low. Many DePIN projects have seen a surge in node numbers due to incentivization, yet the demand for services has not kept pace, leading to resource idleness and limited network activity. This is particularly concerning as many projects target specialized use cases that require technical expertise or specific conditions, effectively excluding a large portion of potential users. This mismatch between supply and demand complicates the incentive structures, making it difficult to stabilize token values and risking a decline in participation.

DIMO stands out as a notable project within the DePIN sector, focusing on automotive data networks. The initiative encourages car owners to install hardware that collects operational data from their vehicles, which is then uploaded to a decentralized network. In exchange, participants earn DIMO tokens, promoting the idea of “data as an asset.” However, the project faces challenges such as high entry costs for hardware and a limited user base, primarily consisting of tech-savvy individuals. While DIMO has made strides in accumulating valuable driving data and forming partnerships, it must overcome barriers to participation and broaden its appeal to reshape the automotive data landscape.

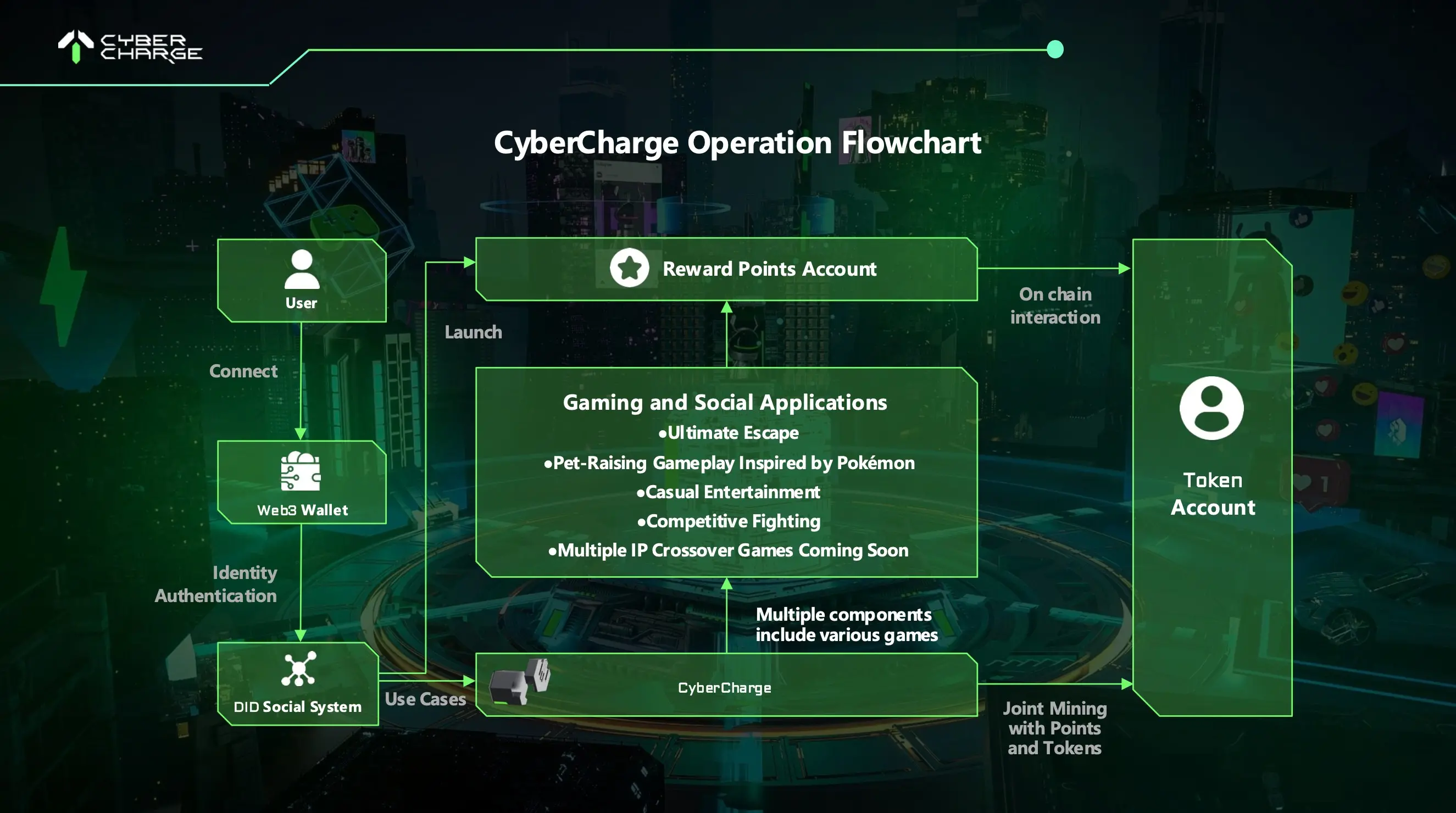

In contrast, CyberCharge presents a fresh approach to DePIN by lowering participation thresholds and enhancing user engagement. Unlike DIMO, which requires specific hardware purchases, CyberCharge utilizes a smart charger that is more accessible and serves a practical purpose. This model encourages broader participation, as anyone with a mobile device can join. Additionally, CyberCharge fosters community engagement through interactive features, creating a more vibrant ecosystem. While still in its early stages, CyberCharge's innovative approach could redefine user interaction in the DePIN space, highlighting the potential for a new generation of projects to address existing challenges and engage a wider audience.

a day ago

The Rise of Practical Cryptocurrencies: Key Players for 2025

In the evolving landscape of cryptocurrency, 2025 is shaping up to be a year where practicality and utility take precedence over mere hype. As the allure of meme tokens wanes, investors are increasingly gravitating towards coins that offer tangible use cases, robust growth potential, and a clear vision for the future. This shift emphasizes the importance of addressing real-world problems, ensuring safety features, and fostering steady growth. Among the coins highlighted, Cold Wallet ($CWT), Filecoin (FIL), Render (RNDR), and Bittensor (TAO) stand out for their innovative approaches and significant growth opportunities.

Cold Wallet ($CWT) is currently in stage 6 of its presale, priced at $0.00773, with expectations of launching at $0.3517, suggesting a potential 500x return on investment. Its unique zero-knowledge systems ensure user privacy, addressing a critical need in the market. Beyond privacy, $CWT is integral to the Cold Wallet ecosystem, unlocking features and rewards, which positions it as a rare asset with substantial growth potential. Analysts are optimistic, with value predictions reaching as high as $3.50.

Filecoin (FIL) continues to lead in decentralized storage, providing a reliable network for NFTs, scientific projects, and applications requiring secure storage. The introduction of the Filecoin Virtual Machine (FVM) has enhanced its capabilities, making storage programmable. Render (RNDR) capitalizes on the growing demand for GPU power, allowing users to rent unused resources efficiently. Lastly, Bittensor (TAO) is pioneering a network that rewards AI tools for their performance, positioning itself as a key player in the AI landscape. Collectively, these cryptocurrencies exemplify the shift towards meaningful digital assets with long-term viability and demand.

4 days ago

IPFS Revolutionizes Data Transmission in Space with Filecoin and Lockheed Martin

The Interplanetary File System (IPFS) has made significant strides in reducing latency for data transmissions in space, as demonstrated by a successful collaboration between the Filecoin Foundation and Lockheed Martin Space. During the Consensus 2025 conference in Toronto, Marta Belcher, president of the Filecoin Foundation, revealed that they have successfully transmitted data using a version of IPFS on a satellite orbiting Earth. This adaptation enhances privacy and security by identifying data based on its content rather than its location, which is particularly beneficial for space communications. The architecture of IPFS is designed to mitigate delays, address data corruption from radiation, and enable cryptographic verification to ensure data integrity.

Belcher highlighted the challenges of data transmission from celestial bodies, noting the multi-second delay from the Moon and multi-minute delay from Mars. The IPFS system allows users to retrieve data based on a content ID from the nearest source, whether it be a personal device, a nearby satellite, or a lunar station. This decentralized approach reduces reliance on centralized data centers and improves the reliability of data storage in environments where hardware may degrade, which is crucial for maintaining the integrity of sensitive materials like satellite images.

The growing interest in decentralized archival storage among media companies and potential military applications of this technology indicate a promising future for IPFS. Belcher emphasized the power of having a deep archive accessible globally, which could revolutionize how media and military organizations manage their data. Additionally, the FIL token, a utility token within the Filecoin ecosystem, boasts a market capitalization of approximately $1.8 billion, reflecting the increasing relevance of decentralized storage solutions in today's digital landscape.

4 days ago

CUDOS at Consensus 2025: Pioneering Decentralized Compute Solutions

The recent Consensus 2025 event highlighted a pivotal shift in the blockchain landscape, emphasizing that decentralized infrastructure has become a necessity rather than an emerging trend. CUDOS took center stage, engaging with Web3 developers and AI infrastructure teams, showcasing their commitment to providing scalable, permissionless, and privacy-preserving compute solutions. The focus was clear: to eliminate gatekeepers and opaque pricing structures that often accompany centralized platforms, thereby promoting a truly decentralized computing environment through the CUDOS Intercloud initiative.

Throughout the event, various themes emerged, particularly around policy and regulation, which are expected to shape the future of blockchain innovation. Keynotes emphasized the growing importance of programmable stablecoins designed to operate outside traditional financial systems, highlighting the increasing demand for reliable infrastructure. The Hackathon Hall buzzed with activity as AI builders and decentralized physical infrastructure (DePIN) projects explored innovative solutions for decentralized inference, mining, and data services. Participants were not only focused on current developments but also on the future of Web3 and the role of AI in driving the next wave of innovation.

CUDOS stands out in this evolving landscape by offering digital wallet-authenticated access to high-performance GPU nodes without the need for accounts or KYC processes. Their cross-chain compatibility makes them a suitable choice for AI, DePIN, and Web3-native applications. As the demand for decentralized compute solutions grows, CUDOS Intercloud is positioned to support projects that require scalable infrastructure without the constraints of centralized control. The message from Consensus 2025 is clear: decentralized compute is essential for the future of AI, blockchain, and digital sovereignty, and CUDOS is at the forefront of this transformation.

5 days ago

Amp and Aethir Shine Amidst Crypto Market Cooling

In a cooling crypto market, Amp (AMP) and Aethir (ATH) have emerged as standout performers, each experiencing a notable 16% increase in value. Amp is currently valued at $0.0051, buoyed by strong bullish momentum supported by key Exponential Moving Averages (EMAs) and favorable trading signals from indicators like MACD and RSI, despite warnings of overbought conditions. Meanwhile, Aethir, which focuses on AI-driven blockchain solutions, has surged to $0.052, breaking past significant resistance levels and maintaining bullish optimism, although the overbought RSI suggests that traders should remain vigilant.

The divergence in the crypto market is evident as Helium (HNT) faces downward pressure, trading at $4.00 and struggling below the critical 200-day EMA. This situation poses a risk of further declines if it breaches the 100-day EMA support at $3.83. The contrasting trajectories of Amp and Aethir against Helium highlight the persistent volatility and innovation within the digital asset market, prompting traders to balance ambition with risk management strategies.

As traders navigate these turbulent waters, the resilience of Amp and Aethir underscores the potential for growth even amid market stagnation. Investors are encouraged to monitor key technical indicators closely, particularly EMAs and RSI levels, to identify optimal entry points and manage risks effectively. The ongoing developments in these projects reflect the dynamic nature of the cryptocurrency landscape, where innovation continues to drive interest and investment opportunities.

5 days ago

Helium: Revolutionizing Telecom with Decentralized Networks

Helium is making waves in the telecom industry by leveraging cryptocurrency to build what could be the most disruptive network in America. Originally starting as an Internet of Things (IoT) initiative, Helium has transformed into the world’s largest decentralized wireless network. With the support of the Decentralized Physical Infrastructure Network (DePIN) movement, Helium is redefining how infrastructure is constructed. Abhay Kumar, Helium's Protocol Lead, emphasized the company's mission: to create wireless infrastructure that fosters innovative business models. This evolution has allowed Helium to expand its services to include both IoT and 5G mobile networks, solidifying its position in the DePIN landscape.

The transition from connecting devices to connecting people has been pivotal for Helium. The launch of Helium Mobile, a new carrier, exemplifies this shift. In the U.S., users can access a free cell phone plan or opt for a limited plan at just $15 per month. Kumar attributes this affordability to Helium's unique protocol, which significantly reduces bandwidth costs for carriers. By utilizing the Helium network, carriers pay only 50 cents per gigabyte, a stark contrast to traditional pricing models. This cost efficiency is largely due to the DePIN model, which incentivizes individuals and businesses to install wireless nodes, such as 5G radios, in exchange for cryptocurrency rewards.

Helium's decentralized infrastructure approach has emerged as a leading example of the potential of DePIN. Kumar noted the company's fortunate timing in establishing this model before it became widely recognized. By allowing local shop owners to contribute to the network, Helium not only enhances customer satisfaction but also enables carriers to extend their reach. The collaborative nature of this model benefits all parties involved, showcasing how decentralized networks can revolutionize the telecom sector and create sustainable business practices.

5 days ago

Crypto Market Resurgence: Theta, Gala, and PayFi Lead the Charge

The crypto market is experiencing a resurgence, with notable gains in tokens like Theta, Gala, and Sandbox, which have reignited interest in the metaverse and GameFi sectors. Theta Network has seen a remarkable 37% price increase, buoyed by a partnership with Nanyang Technological University to develop EdgeCloud AI infrastructure. This collaboration aims to enhance decentralized video streaming and NFT platforms, positioning Theta as a leader in AI-powered Web3 services. Despite a slight price correction, the overall trend remains bullish, reflecting growing investor confidence.

Gala Games is also riding a wave of optimism, with its token GALA surging nearly 47% following a high-profile partnership with the White House to create a Web3-based Easter Egg Hunt game set for 2025. This unexpected collaboration has not only boosted GALA's price but also sparked interest in the GameFi sector, leading to a broader uplift in the crypto market. The sustained gains and high buying interest indicate a strong recovery and renewed enthusiasm among investors, showcasing Gala's potential for mainstream adoption.

Amidst these developments, PayFi is emerging as a transformative force in the crypto landscape. Platforms like Remittix are redefining cross-border payments by enabling instant crypto-to-fiat transfers without requiring users to have extensive crypto knowledge. With support for over 50 crypto pairs and a user-friendly interface, PayFi is poised to revolutionize real-world finance. As the crypto market continues to evolve, the focus on practical innovations like PayFi suggests that 2025 could mark a significant shift toward mainstream adoption of blockchain technology in everyday financial transactions.

Signup for latest DePIN news and updates