The DePIN Explorer - DePIN Scan

Trending 🔥

DePIN Market Cap

$26,481,257,591

-0.1%

Volume

$8,540,239,283

-11.0%

DePIN Projects

296

DePIN Devices

19,032,581

+0.2%

DePIN Projects

Mineable page highlights DePIN projects with devices that you can mine tokens or points with. Currently 18 DePIN projects are listed here.

Device Name | Project | Category | AVG Miners Cost | Days to Breakeven | Estimated Daily Earnings | Number of On-Chain Devices | Revenue | Device Public Sale |

|---|---|---|---|---|---|---|---|---|

| XNet Mobile |  | Wireless | $249.48 | 84 | $2.97 | - | - | |

| N3 Edge V1 | .jpg) | AI | $900 | 101 | $8.884 | 5,186 | ~$100K/Month | |

| Hivemapper |  | SensorAI | $318.66 | 113 | $2.82 | - | - | |

| GEODNET - Triple Band |  | Sensor | $694.54 | 138 | $5.04 | - | - | |

| GEODNET - Dual Band |  | Sensor | $399.02 | 155 | $2.57 | - | - | |

| Helium - Mobile |  | Wireless | $259.2 | 240 | $1.08 | - | - | |

| Phoenix 01 |  | AICompute | $1,300 | 365 | $3.5 | - | - | |

| DIMO |  | Sensor | $300 | 375 | $0.8 | - | - | |

| AscensionWx |  | Sensor | $101.04 | 421 | $0.24 | - | - | |

| Helium IOT |  | Wireless | $300.52 | 683 | $0.44 | - | - | |

| enviroBLOQ |  | Sensor | $254.72 | 796 | $0.41 | - | - | |

| WiCrypt |  | Wireless | $211.37 | 919 | $0.23 | - | - |

2 days ago

Leading DePIN Projects in Social Activity Revealed by Phoenix GroupDecentralized Physical Infrastructure Networks (DePINs) are increasingly becoming a pivotal part of the blockchain ecosystem, effectively bridging the gap between real-world applications and digital infrastructure. Recent data from Phoenix Group highlights several leading DePIN projects based on social activity, including $TAO, $EGLD, $RENDER, and $HOT. These projects have garnered significant attention on social media, showcasing the growing interest in decentralized solutions that leverage physical infrastructure.

Among these projects, $TAO stands out as the leader in social engagement, boasting 9.2K engaged posts and a remarkable 1.9 million interactions. Following closely is $RENDER, which has achieved 8.9K engaged posts and 1.8 million interactions. $EGLD ranks third with 8.1K engaged posts and 1.2 million interactions. Other notable mentions include $ICP and $HOT, which occupy the fourth and fifth positions, respectively, with engaged posts and interactions reflecting their growing community involvement.

The list continues with $AKT, $FIL, and $DIONE, which also demonstrate substantial engagement levels. However, $TRAC finds itself at the bottom of the list, with 2.3K engaged posts and 215.5K interactions. This ranking underscores the varying levels of community interest and activity across different DePIN projects, indicating a dynamic landscape within the blockchain sector as these projects strive to enhance their visibility and user engagement.

3 days ago

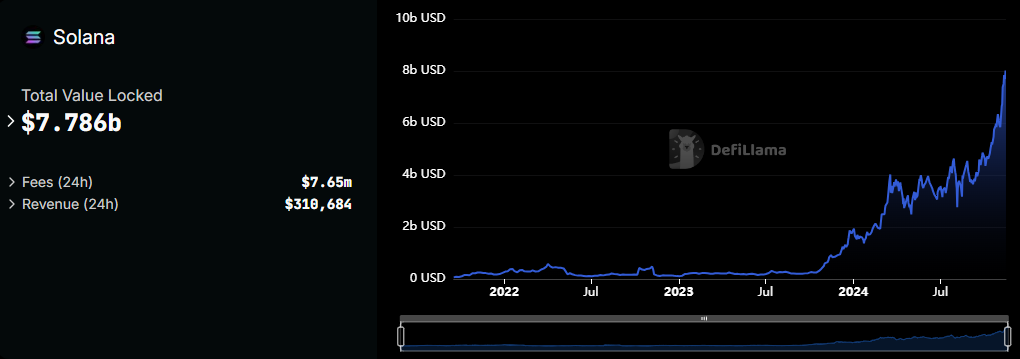

Solana Surges to 111% of Ethereum's Economic Value Amid DeFi GrowthIn October, Solana's real economic value (REV) reached an impressive 111% of Ethereum's, driven by significant growth in decentralized finance (DeFi) and innovative projects such as Hivemapper and Helium. The price of Solana (SOL) surged by 36% recently, hitting $213, but it now faces a crucial challenge at the $221 resistance level. Despite strong network activity and a notable increase in staking, concerns linger about the sustainability of this momentum. The decentralized exchange (DEX) volumes have also seen a remarkable rise, with daily trading exceeding $5 billion for three consecutive days last week, totaling $16 billion from November 10 to 15, primarily driven by Raydium and Orca.

Staking activity has emerged as a key factor in bolstering investor confidence, with over $8 billion worth of SOL staked, which helps alleviate selling pressure and enhances price stability. This represents one of Solana's strongest metrics during its current rally. Technical indicators support a positive outlook, as the average directional index (ADX) for SOL stands at 32, indicating a strong trend. However, the inability to breach the $221 barrier could result in a price range between $201 and $221 in the short term, with potential pullbacks signaling a reversal of the bullish trend.

Solana's DeFi ecosystem continues to thrive, with meme coin trading contributing to a daily volume of $1 billion, showcasing its growing appeal among retail traders. The network's impact extends beyond DeFi, with projects like Hivemapper mapping a significant portion of global roads and Helium expanding its device network. With robust staking, increasing transaction volumes, and strong technical indicators, Solana is poised for further growth. However, breaking the $221 resistance is critical for unlocking greater potential, with medium-term targets projected between $400 and $500, supported by a bullish cup-and-handle formation on its chart.

3 days ago

Aptos, Bittensor, and BlockDAG: The Latest Movers in CryptocurrencyIn the ever-evolving world of cryptocurrency, Aptos (APT) has made headlines with a notable 21% surge, bouncing back after a significant drop earlier this month. This resurgence is attributed to the cryptocurrency reaching its Fibonacci retracement level, which has sparked renewed optimism among investors. The increase in active addresses, peaking at 1.27 million in June, further supports this bullish trend. As of now, Aptos is trading at approximately $9.38, with analysts suggesting a potential rise of another 19% to reclaim its October peak.

Meanwhile, Bittensor (TAO) has also experienced a remarkable 20% jump in a single day, driven by positive sentiment following recent elections. However, the cryptocurrency faces resistance as indicated by the Ichimoku Cloud, which could pose challenges for further upward movement. The Relative Strength Index (RSI) has surged into the overbought territory, suggesting that while there is strong buying interest, a correction may be imminent if the momentum does not sustain. Traders are closely monitoring TAO's short-term moving averages for signs of a trend reversal that could lead to higher resistance targets.

The standout performer in the current market is BlockDAG (BDAG), which has successfully raised over $122 million in its presale, attracting significant attention from investors. With over 15.3 billion coins sold at a price of $0.0234, early participants have already seen returns exceeding 2240%. BlockDAG’s innovative DAG-PoW technology positions it as a strong contender in the Layer-1 blockchain space, aiming for a target of $600 million. As the presale progresses, the urgency for investors to join increases, highlighting BlockDAG as a potential breakout altcoin that could redefine the market landscape.

3 days ago

The Impact of Upbit Listing Success Rate and UDC Conference Overview**The Impact of Upbit Listing Success Rate and UDC Conference Overview**

Recently, with the market gaining strength, the wealth effect of new listings on Upbit has become more prominent. Tokens like AGLD saw a staggering 150% increase on the first day, while DRIFT surged by 190%. Tokens like SAFE, CARV, and PEPE also experienced a 100% increase. The Formula team made a fortune through news trading, showcasing the potential for wealth creation on Upbit. How can we seize the wealth wave of new listings on Upbit? The UDC conference serves as a barometer for Upbit listings. The listing success rate from 2018 to 2023 stands at 76%. On November 14th, the UDC conference was held as scheduled, offering a glimpse into the participating projects. UDC, organized by Dunamu since 2018, is a representative blockchain conference in South Korea aimed at promoting industry development, ecosystem growth, and adoption. This year's theme, 'Blockchain: Driving Real-World Change,' delves into how blockchain is expanding into various industries and bringing about real-world transformations. According to Layerggofficial data, from 2018 to 2023, approximately 66 projects participated in UDC, with 37 projects already listed on KRW Fair before UDC. Among the remaining 29 projects, 13 were listed in KRW form after UDC (44.8%). The significance of the UDC conference and the wealth effect on Upbit stem from various factors.

UDC's Importance and Upbit's Wealth Effect

Upbit, as South Korea's largest exchange, holds a leading position in the Korean market in terms of trading volume and user numbers, commanding around 73% of the market share. Korean investors can directly purchase cryptocurrencies using the Korean Won (KRW), leading to significant wealth effects. The convenience of deposits and substantial wealth effects have propelled cryptocurrency trading volume in Korea beyond the country's stock market. This dynamic ensures strong buying interest for new tokens listed on Upbit. The UDC conference, organized by Dunamo, Upbit's parent company, though slightly smaller in terms of timing and participation compared to events like KBW, holds undeniable importance. Projects like ZRO, MNT, and STG, which participated in last year's conference, were listed on Upbit this year, indicating the enduring influence of the conference. Data source: [Layerggofficial](https://x.com/layerggofficial/status/1714145904943587774?s=46)

UDC 2024 Conference Projects

The UDC conference for this year has already taken place, with projects like Axelar, Taiko, Zetachain, Mantle, and Cyber already listed on Upbit. As of the conference, there are still 11 projects yet to be listed on Upbit or to have KRW trading pairs. Projects awaiting listing include SLP, HNT, GALA, NFT, and ROSE. Projects already listed with BTC pairs but without KRW pairs include MKR, YGG, IOTX, and Cyber. Projects that have not launched tokens but participated in UDC include Linea and Magic Eden. Compliance and AI remain strong narratives in line with this year's UDC theme. Despite Oasis Network not participating in this year's UDC, leveraging AI narratives, ROSE saw a surge on November 5th. Additionally, South Korea's high interest in NFTs and the gaming market suggests that Magic Eden's token has a high probability of being listed on Upbit. Apart from the forward-looking impact of the UDC conference, another South Korean exchange, Bithumb, also has relevance to Upbit listings. Both exchanges tend to list coins in clusters based on narratives, such as introducing AI tokens simultaneously at the beginning of the year or focusing on Memecoins currently. To protect investors, Korean exchanges typically avoid small, new coins with short market history, opting for older coins with stable market capitalization and prices.

.jpg)