Latest DePIN News

3 months ago

Trump's White House Crypto Summit: Key Attendees and Industry Reactions

The upcoming White House Crypto Summit, hosted by US President Donald Trump, is set for March 7 and has generated significant interest within the cryptocurrency community. Despite the event's high profile, the attendee list is notably exclusive, with only 20 to 25 invitees expected to participate. Key figures from the Presidential Working Group on Digital Assets, including Treasury Secretary Scott Bessent and SEC Chair, are confirmed to attend. Additionally, a larger reception for those not invited to the roundtable is being organized nearby, indicating the event's importance and the administration's focus on digital assets.

Among the confirmed attendees are prominent industry leaders such as Michael Saylor, Coinbase CEO Brian Armstrong, and Kraken CEO Arjun Sethi. Their participation highlights the summit's role in fostering dialogue between the government and the cryptocurrency sector. Attendees have expressed enthusiasm about the opportunity to collaborate with the Trump administration, with several sharing their excitement on social media. This summit represents a critical moment for the crypto industry as it seeks to engage with policymakers and shape the regulatory landscape in the United States.

However, not all industry leaders are represented at the summit. Ripple CEO Brad Garlinghouse has not confirmed his attendance, raising questions about the inclusivity of the event. Additionally, representatives from the Solana and Cardano ecosystems have remained silent regarding their participation, despite President Trump's recent announcement about establishing a crypto strategic reserve. As the summit approaches, the cryptocurrency community is keenly watching how these discussions will influence the future of digital assets in America.

3 months ago

ETHDenver Highlights: Growth and the Need for Broader Engagement in Web3

ETHDenver recently concluded, and it was a vibrant gathering where the atmosphere was lively, with attendees enjoying the camaraderie typical of web3 events. However, two significant observations emerged from the conference. Firstly, the event has grown too large for its original venue, indicating a burgeoning interest and participation in the web3 space. Secondly, there is a pressing need for the Web3 sector to broaden its horizons and engage with industries beyond its current scope.

One of the highlights of ETHDenver was the series of live interviews conducted by DCN with projects focusing on Decentralized Physical Infrastructure (DePIN). These projects represent a unique intersection between the physical and digital realms, showcasing how blockchain technology can be applied to real-world infrastructure. This blend of digital innovation with tangible applications is crucial for the evolution of web3, as it opens up new avenues for growth and collaboration.

As the web3 community continues to expand, it is essential for participants to explore partnerships and integrations with traditional sectors. This will not only enhance the relevance of blockchain technologies but also facilitate a more inclusive ecosystem that can address various societal challenges. The discussions and insights gathered from ETHDenver could serve as a catalyst for such developments, driving the web3 movement forward into new territories and applications.

3 months ago

Theta Labs Partners with Kangwon National University to Enhance AI Research

Theta Labs has recently expanded its AI research partnerships by welcoming Kangwon National University into its Theta EdgeCloud decentralized GPU network. This collaboration marks a significant milestone, as Kangwon National University becomes the 23rd academic customer of Theta EdgeCloud. The partnership aims to enhance AI research capabilities, achieving an impressive GPU utilization rate exceeding 85% across Theta's global network, alongside more than 230 million TFUEL locked by Elite Booster node operators. The EdgeCloud platform is already supporting various enterprises and academic institutions, including NHL teams and renowned universities, thus solidifying its role in advancing AI research and real-world applications.

Professor Kyeongpil Kang, who leads the Data Analytics & Machine Intelligence (DAMI) Lab at Kangwon National University, specializes in natural language processing, machine learning, and data mining. The DAMI Lab focuses on large-scale AI research, exploring areas such as fine-tuning large language models (LLMs), machine learning solutions for specific domains, and AI-driven insights in fields like social sciences and medical AI. The collaboration with Theta EdgeCloud will provide the lab with access to a hybrid cloud-edge GPU computing platform, enabling researchers to conduct innovative experiments and develop advanced AI applications.

As the partnership progresses, both Professor Kang and Mitch Liu, co-founder and CEO of Theta Labs, express excitement about the potential of this collaboration. Liu emphasizes the importance of expanding GPU infrastructure to meet the growing demand while maintaining cost-effectiveness. The goal for 2025 includes a tenfold increase in the customer base, achieving over 95% GPU utilization, and locking in more than 2 billion TFUEL through elite edge node operators. This partnership not only enhances the capabilities of DAMI Lab but also strengthens Theta Labs' position in the decentralized cloud infrastructure space for AI and machine learning.

3 months ago

Aethir Achieves Revenue Milestone in DePIN Sector

Aethir, a key player in the decentralized physical infrastructure networks (DePIN) sector, has recently achieved a significant milestone by ranking first in revenue among DePIN projects over the past 30 days. This achievement has garnered considerable attention within the blockchain and cryptocurrency communities. Previously, in the Messari 2024 DePIN Report, Aethir was noted as the second highest in annual revenue, and it also topped the revenue charts for February. This consistent performance positions Aethir as a frontrunner in the DePIN landscape, showcasing its potential for continued growth and success.

Operating within the computing sub-sector of DePIN, Aethir is rapidly expanding its market presence. According to recent data from depinscan, it ranks as the second largest infrastructure project in this space, following its main competitor, Grass. Aethir boasts a decentralized cloud computing network comprising over 400,000 GPU containers, including more than 3,000 high-performance NVIDIA H100 and H200 GPUs designed for advanced AI workloads. This extensive infrastructure allows Aethir to meet the increasing demand for decentralized cloud computing services, particularly those requiring robust AI capabilities, and ensures a reliable user network across 95 global locations.

Despite facing challenges, including a missed opportunity to capitalize on the integration of AI agents into its cloud network, Aethir remains competitive due to its diverse offerings and global infrastructure. The DePIN ecosystem is evolving, with growing interest in decentralized infrastructure, particularly in the Eastern United States. Aethir is well-positioned to benefit from this trend, although it must continue to innovate to maintain its leading position amid fierce competition. As the decentralized cloud computing market expands, Aethir's recent revenue success suggests it is on the right track, but the coming months will be crucial in proving the sustainability of its growth.

3 months ago

Surge in DePIN Investments and Web3 Gaming: A New Era for Blockchain

In recent months, venture capital investments in decentralized infrastructure, particularly Decentralized Physical Infrastructure Networks (DePINs), have surged, signaling a shift in how traditional industries may operate. This trend is complemented by a notable increase in funding for Web3 gaming, reflecting a growing belief in blockchain's potential to revolutionize entertainment. As the crypto market experiences volatility, with Bitcoin's price fluctuating dramatically, investors are still finding confidence in long-term opportunities within blockchain and crypto startups. Key areas of focus include DePINs, Web3 gaming, and the tokenization of Real-World Assets (RWAs), which are seen as vital connections between traditional finance and the digital economy.

A prime example of this trend is Alchemy's launch of a $5 million "Everyone Onchain Fund" aimed at accelerating Web3 adoption on Ethereum. By providing developers with significant credits for gas and computing, Alchemy is lowering barriers for new projects. This initiative not only supports developers but also enhances the Ethereum ecosystem's capabilities. Similarly, Mavryk Dynamics has secured $5 million to develop a layer-1 RWA tokenization platform, aiming to bridge traditional finance and DeFi. With over $360 million in RWAs already secured, Mavryk is poised to play a crucial role in the growing demand for on-chain asset representation.

The decentralized derivatives market is also gaining traction, as evidenced by Rho Labs' recent $4 million seed round. Rho Protocol facilitates a decentralized rates exchange, allowing users to engage in staking, lending, and trading perpetual futures. This innovation is critical for normalizing funding rates between centralized and decentralized finance, enhancing the overall efficiency of the crypto landscape. As these developments unfold, the integration of blockchain technology into various sectors, including gaming and finance, continues to reshape the future of digital economies, highlighting the immense potential of Web3 solutions.

3 months ago

Ankr Price Prediction: Analyzing Future Potential for ANKR Token

In recent weeks, the utility token of the Ankr project has experienced a significant price drop of approximately 24%. However, there are signs that the coin is beginning to recover. Ankr, established in 2017, is a Web3 platform that facilitates the creation of decentralized applications and networks. The platform has evolved from utilizing surplus server capacity to providing services such as liquid staking, RPC services, and tools for launching private blockchains. Ankr operates as a cloud computing marketplace, enabling users to rent out unused computing power, which benefits both suppliers and users seeking affordable cloud services. The platform's utility token, ANKR, is used for various purposes including payments, staking, and voting on project updates, with a total supply capped at 10 billion tokens.

As of March 4, 2025, ANKR is trading at around $0.018, which is a staggering 91.4% decrease from its all-time high of $0.213 recorded in April 2021. Despite the recent downturn, many analysts believe that Ankr has the potential to rebound due to its solid foundation and the increasing demand for decentralized services. Short-term predictions from CoinCodex suggest that ANKR could rise to $0.0815 by March 28, although the overall investor sentiment remains bearish. Looking further ahead, projections for 2025 indicate that ANKR could trade between $0.0205 and $0.0846, with Wallet Investor estimating a more conservative average price of $0.0268.

Looking towards 2030, forecasts vary significantly. CoinCodex anticipates a price range of $0.0175 to $0.1295, while DigitalCoinPrice predicts a minimum of $0.0976 and a maximum of $0.11. Wallet Investor offers an even more optimistic outlook, projecting an average price of around $0.0422 by early 2030, with a potential peak of $0.198. While these predictions suggest a potential for growth over the next five years, it is essential to remember that cryptocurrency investments are speculative and highly dependent on market conditions. Investors should conduct thorough research before making any decisions regarding ANKR investments.

3 months ago

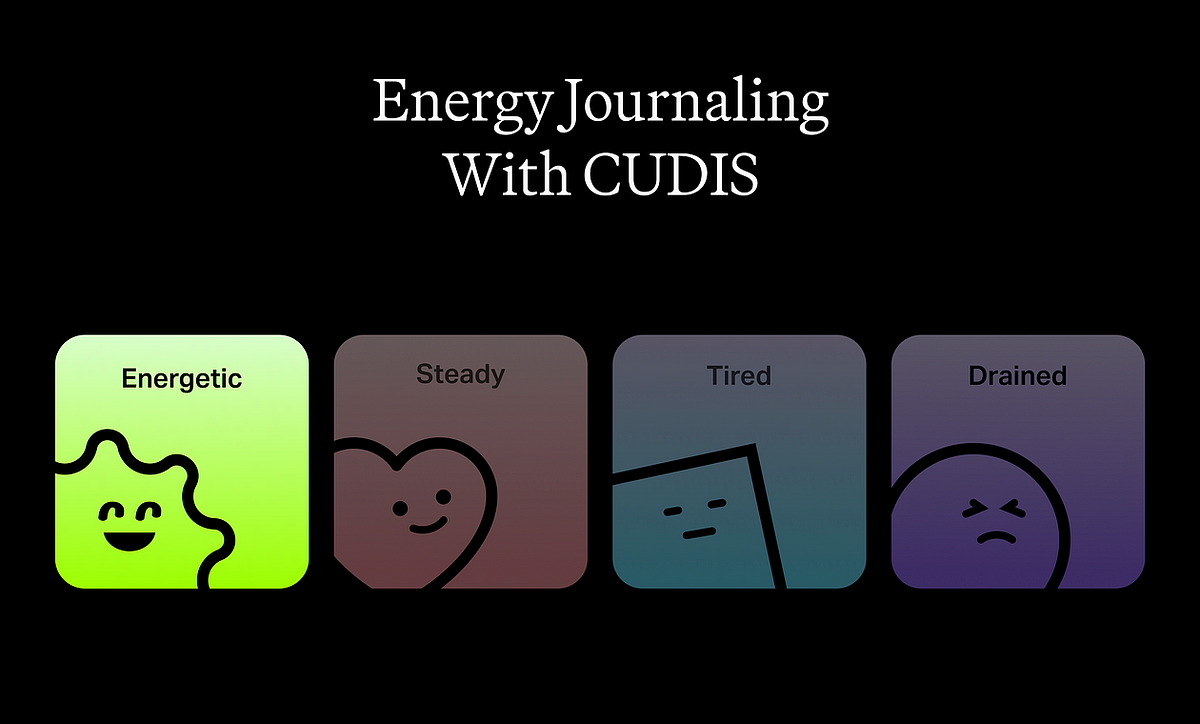

CUDIS Launches Energy Journal Feature to Enhance Wellness Tracking

CUDIS has recently launched version 1.3.10 of its app, introducing an innovative feature called the Energy Journal. This new functionality allows users to log their daily energy and mood levels on the blockchain, creating a permanent record that can significantly enhance sentiment studies and personal wellness algorithms. By tracking energy levels, users can gain insights into their mental and physical well-being, which can lead to positive changes in their lives. The data is securely stored on-chain, ensuring its immutability and contributing to the expanding CUDIS ecosystem.

Tracking energy levels is essential for understanding one's mental health, similar to monitoring sleep quality and stress. The CUDIS AI Agent analyzes the self-reported data alongside other health metrics, providing personalized insights and actionable advice. Users are encouraged to log their energy levels consistently, honestly, and to recognize both positive and negative triggers. This practice not only fosters self-awareness but also allows users to earn in-app rewards such as raffle entries and SALUS points, incentivizing them to maintain their tracking routine.

CUDIS rewards users for their commitment to logging energy levels, offering various incentives based on streaks of consistent tracking. For example, a 7-day streak earns users 2 raffle entries and 100 SALUS points, while a 60-day streak can yield 7 raffle entries and 1,000 SALUS points. The raffles provide a guaranteed chance to win exciting rewards, including Edamame NFTs and USDC prizes. Additionally, SALUS points can be redeemed within the CUDIS marketplace and are linked to early user adoption airdrops during the upcoming CUDIS Token Generation Event (TGE). This unique approach not only enhances user engagement but also promotes a healthier lifestyle through the power of blockchain technology.

3 months ago

Hivello Integrates with Nosana to Enhance GPU Earning Opportunities

Hivello, a prominent aggregator of decentralized physical infrastructure networks (DePINs), has announced its latest integration with Nosana, a decentralized compute network that specializes in powering AI and CI/CD workloads through GPU resources. This collaboration is poised to enhance earning opportunities for users with GPUs, as Nosana ranks among the most lucrative DePIN networks for GPU-based computing. The integration allows Hivello users to efficiently connect their idle GPU power, thereby maximizing their earnings while contributing to the decentralized ecosystem that supports AI model training and continuous software integration.

The timing of this integration aligns with Hivello's rapid ecosystem expansion, particularly following the successful listing of its $HVLO token on major exchanges such as Gate.io, MEXC, and Raydium. This increased liquidity and accessibility for $HVLO positions Hivello to attract a larger number of new node operators, which is expected to further bolster the decentralized compute landscape. With Nosana now part of Hivello’s automated compute aggregation platform, the company anticipates a significant increase in GPU node participation, allowing more users to earn rewards, stake $HVLO, and contribute to the burgeoning field of DePIN-powered applications.

Domenic Carosa, Co-Founder and Chairman of Hivello, emphasized the importance of decentralization in the future of infrastructure, stating, "Nosana’s integration is another step toward making GPU-powered compute more accessible, rewarding, and scalable." Hivello aims to simplify participation in various DePIN networks, enabling users to earn passive income by mobilizing their idle computing resources without requiring technical expertise. This initiative reflects Hivello's commitment to fostering a more open and distributed infrastructure, making advanced technologies accessible to a wider audience.

3 months ago

Beamable.Network: Pioneering Decentralized Infrastructure for Game Development

The landscape of live service games is rapidly evolving, with developers increasingly seeking decentralized infrastructure to address the challenges posed by traditional centralized systems. At ETH Denver 2025, the demand for solutions like Beamable.Network was evident, as developers expressed their desire for open-source, community-owned networks that provide greater control and reduce the risks associated with shifting corporate strategies. Beamable.Network has emerged as a leading decentralized physical infrastructure (DePIN) project, recognized for its ability to facilitate faster, more cost-effective game development while mitigating the existential threats posed by centralized providers.

Centralized infrastructure has long been a source of frustration for game developers, who face the risk of service shutdowns and unexpected pricing changes from providers like Amazon and Unity. The fragility of relying on a single provider for critical game infrastructure can lead to costly migrations and operational disruptions. Beamable.Network addresses these issues by offering a decentralized alternative that empowers studios to control their tech stack, reduce dependency on any one provider, and benefit from a competitive pricing model. With over 80 games already utilizing the platform, the shift towards decentralized infrastructure is not just a theoretical concept but a practical solution that is gaining traction in the gaming industry.

The implications of Beamable.Network extend beyond gaming, as the DePIN concept is being embraced across various sectors, including cloud computing and AI workloads. By decentralizing physical infrastructure, Beamable.Network fosters a competitive environment where data centers vie for capacity, allowing studios to stake tokens for reliable compute access. This innovative approach not only lowers costs significantly but also accelerates development by providing a flexible and interoperable backend. As the gaming industry continues to lead the charge towards decentralized solutions, Beamable.Network exemplifies how open infrastructure can revolutionize the way developers build and sustain their games, ensuring they are well-equipped for the future.

3 months ago

Venture Capital Firms Boost Blockchain Investments Amid Crypto Volatility

The first quarter of 2025 has proven to be a tumultuous period for the cryptocurrency market, characterized by extreme fluctuations in investor sentiment. Bitcoin (BTC) experienced a remarkable rally to all-time highs, followed by a significant correction, all while receiving notable support from political figures such as Donald Trump. Amidst this volatility, venture capital firms have been actively expanding their investments in blockchain and crypto startups, particularly in areas such as decentralized physical infrastructure networks (DePINs), Web3 gaming, real-world asset (RWA) tokenization, and derivatives exchange markets. The latest VC Roundup highlights seven significant funding announcements across the industry.

Among the notable developments, Alchemy has launched a $5 million "Everyone Onchain Fund" aimed at promoting Web3 adoption on Ethereum. This initiative will provide developers with gas and computing credits to facilitate their projects. Alchemy's partnership with World, a biometric digital identity project, has already garnered over 23 million users. Additionally, Mavryk Dynamics secured $5 million in funding to develop a layer-1 RWA network, bridging traditional finance with decentralized finance (DeFi) through innovative non-custodial features. The RWA market has seen substantial growth, reaching $17.9 billion as of early March.

Other significant funding rounds include Rho Labs, which raised $4 million for its decentralized rates exchange, and Teneo Protocol, which closed a $3 million round to democratize social media data. Furthermore, Fluent Labs raised $8 million to enhance its Ethereum layer-2 network, while The Game Company secured $10 million to develop a cloud gaming infrastructure. Lastly, ACID Labs, a Web3 gaming studio, received $8 million to scale its social gaming platform on Telegram. These investments reflect a growing confidence in the potential of blockchain technology across various sectors, particularly in gaming and decentralized finance.

Signup for latest DePIN news and updates