Aethir Achieves Revenue Milestone in DePIN Sector

Aethir, a key player in the decentralized physical infrastructure networks (DePIN) sector, has recently achieved a significant milestone by ranking first in revenue among DePIN projects over the past 30 days. This achievement has garnered considerable attention within the blockchain and cryptocurrency communities. Previously, in the Messari 2024 DePIN Report, Aethir was noted as the second highest in annual revenue, and it also topped the revenue charts for February. This consistent performance positions Aethir as a frontrunner in the DePIN landscape, showcasing its potential for continued growth and success.

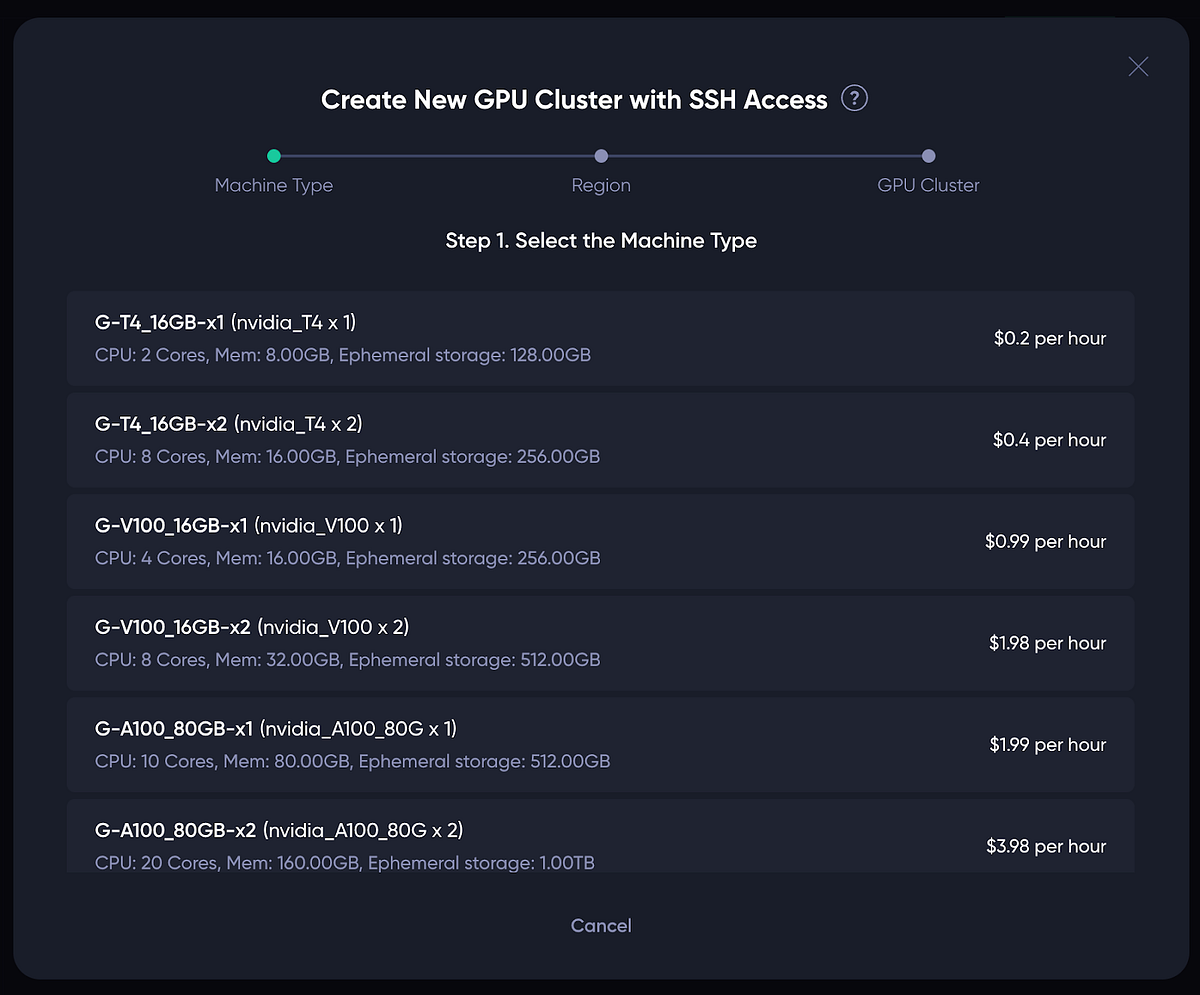

Operating within the computing sub-sector of DePIN, Aethir is rapidly expanding its market presence. According to recent data from depinscan, it ranks as the second largest infrastructure project in this space, following its main competitor, Grass. Aethir boasts a decentralized cloud computing network comprising over 400,000 GPU containers, including more than 3,000 high-performance NVIDIA H100 and H200 GPUs designed for advanced AI workloads. This extensive infrastructure allows Aethir to meet the increasing demand for decentralized cloud computing services, particularly those requiring robust AI capabilities, and ensures a reliable user network across 95 global locations.

Despite facing challenges, including a missed opportunity to capitalize on the integration of AI agents into its cloud network, Aethir remains competitive due to its diverse offerings and global infrastructure. The DePIN ecosystem is evolving, with growing interest in decentralized infrastructure, particularly in the Eastern United States. Aethir is well-positioned to benefit from this trend, although it must continue to innovate to maintain its leading position amid fierce competition. As the decentralized cloud computing market expands, Aethir’s recent revenue success suggests it is on the right track, but the coming months will be crucial in proving the sustainability of its growth.

Related News