Latest DePIN Token Launch News

View Token Launch Projects

a month ago

Conor McGregor's REAL Memecoin: A Cautionary Tale in Crypto Fundraising

Conor McGregor, the renowned Irish mixed martial artist, has recently ventured into the cryptocurrency space with the launch of his memecoin, "REAL." This digital token aims to revolutionize the crypto landscape by offering staking rewards and governance rights within its ecosystem. However, the fundraising efforts for REAL faced significant challenges, raising only $392,315 out of a targeted $1,008,000 during a 28-hour presale. The auction's failure prompted the Real World Gaming (RWG) decentralized autonomous organization to announce full refunds for all bids, as McGregor continues to promote the project with his characteristic enthusiasm, stating, "Ladies and gentlemen, this is REAL!" The team is now considering a relaunch with a revised fundraising strategy to enhance the token's appeal.

Several factors contributed to the unsuccessful fundraising of the REAL memecoin. The launch coincided with a downturn in the cryptocurrency market, where major coins like Ether and Solana experienced significant declines. Additionally, economic uncertainties stemming from global tariff reorganizations and fears of recession made investors more cautious. The memecoin space has also been marred by scams, leading to a general distrust among potential investors. Misinterpretations of REAL's objectives and skepticism towards celebrity-backed tokens further complicated the fundraising efforts, as many viewed it merely as another celebrity-endorsed project.

The failure of REAL's fundraising serves as a cautionary tale for investors in the crypto space. It underscores the importance of looking beyond celebrity endorsements and understanding the fundamentals of a project. Investors should conduct thorough research to assess a token's utility, community engagement, and overall credibility. The incident highlights the need for regulatory clarity in celebrity endorsements to protect retail investors and maintain the integrity of the cryptocurrency market. As the crypto landscape continues to evolve, genuine trust and long-term vision will prove more valuable than mere fame in fundraising efforts.

a month ago

Fartcoin: The Surprising Rise of a Memecoin in Solana's AI Sector

In the ever-evolving cryptocurrency landscape, few tokens have garnered as much attention as Fartcoin, a Solana-based AI memecoin. Despite its nascent status, Fartcoin has established a notable presence on social media platforms, particularly Twitter, where it is perceived as a buy signal by savvy investors. This Belarus-born memecoin has quickly positioned itself as a frontrunner within the Solana ecosystem, outpacing many of its more established competitors. With a market cap of $455.2 million, Fartcoin now commands 32.1% of the total market cap of AI tokens on Solana, which stands at approximately $1.1148 billion across 772 projects.

Fartcoin's rise is particularly remarkable given that it lacks the typical utility or technological claims associated with many AI tokens. Instead, it has leveraged the current enthusiasm surrounding artificial intelligence to carve out a significant niche in the market. Its performance has eclipsed that of established tokens like #ai16z, with Fartcoin's market cap exceeding that of its nearest competitor by nearly 250%. This unexpected success raises questions about the future of AI tokens on the Solana blockchain, suggesting a potential shift in investor interest towards lighter, meme-based projects over more traditional tech-heavy solutions.

The appeal of Fartcoin among institutional investors, often referred to as "smart money," is a key driver of its success. These investors are drawn to Fartcoin's unique position in the market, where its meme culture and community engagement have proven to be powerful assets. As Fartcoin continues to attract significant investment and attention, its future remains uncertain, but its current trajectory indicates that it has established itself as a formidable player in the AI sector on Solana. Ultimately, Fartcoin exemplifies the unpredictable nature of the cryptocurrency world, where even a memecoin can dominate a market segment traditionally reserved for more serious projects.

a month ago

Top 3 Altcoins to Watch as Crypto Market Prepares for Breakout

The crypto market is currently showing signs of a potential breakout, with altcoins gaining momentum rapidly. Historically, significant price movements begin quietly, allowing astute investors to position themselves before explosive growth occurs. For those seeking undervalued altcoins with substantial upside potential, now is an opportune moment to invest. Among the top contenders, Kaanch Network stands out as a presale-stage project poised for significant gains.

Kaanch Network (KAANCH) is a high-utility altcoin designed for real-world applications, including tokenized supply chains and decentralized AI. Currently in its active presale phase, it presents a unique entry point before it gains traction through exchange listings and media attention. The project is gaining popularity among early investors due to its innovative approach and alignment with major trends like DePIN and AI. With strong community support and early venture capital interest, Kaanch Network is well-positioned for a breakout.

Other notable altcoins include Injective Protocol (INJ) and Theta Network (THETA). Injective Protocol is a high-speed derivatives engine tailored for DeFi applications, benefiting from the resurgence of decentralized finance and increasing trading volumes. Meanwhile, Theta Network focuses on decentralized video streaming and content delivery, capitalizing on the shift towards Web3 entertainment. As these projects continue to develop and attract attention, investors are encouraged to act quickly before these tokens experience significant price increases.

2 months ago

Exploring the Best Crypto Airdrops of 2024

Airdrops have emerged as a prominent marketing strategy within the blockchain space, enabling projects to reward early adopters and attract new users by distributing free tokens. Participants can earn these tokens by completing simple tasks, such as following projects on social media or joining their community groups. In 2024, several notable airdrops are available, including Grass, a DePIN network that leverages idle internet bandwidth, and RetroBridge, a multi-chain token bridging platform. Other projects like WalletConnect and Rainbow Wallet are also offering airdrops, enhancing user engagement through point rewards and utility tokens.

Grass, for instance, allows users to earn Grass Points by running a node on their computer, with the potential for these points to convert into tokens in the future. The project has already distributed 100 million tokens to over 2 million users in its first airdrop phase and is currently in the second phase, distributing 17% of the total supply. Similarly, RetroBridge incentivizes users through various tasks, including token bridging and social media engagement, with plans to launch a marketplace for users to exchange their earned points for tokens in 2025.

As the landscape of crypto airdrops continues to evolve, platforms like Summer.fi and Zeek are also gaining traction by offering unique rewards systems. Summer.fi rewards users for engaging with DeFi protocols, while Zeek allows users to monetize their knowledge through a social network. However, participants should exercise caution, as not all airdrops are legitimate. Conducting thorough research and ensuring the authenticity of projects is crucial to mitigate risks associated with potential scams. Overall, airdrops remain a compelling way for users to engage with the blockchain ecosystem and potentially earn free cryptocurrency.

2 months ago

Get Goated Season 2: Upcoming Token Rewards and Claim Process

The Get Goated Season 2 reward distribution is entering its next phase, following the successful $IOTX claim phase where millions of tokens were distributed to community participants. The claim window for $IOTX officially closed on March 27, with any unclaimed tokens reverting to the IoTeX Treasury Pool. The community will decide on the future use of these tokens through an IoTeX Improvement Proposal (IIP). As the program progresses, participants are reminded to claim their rewards before the deadline to avoid missing out on their allocations.

Starting April 7, 2025, participants can claim token rewards from the first batch of ecosystem sponsors, which includes Geodnet, Uprock, Drop Wireless, and Network3. Prior to claiming, there will be a review window from March 28 to March 31, where participants can verify their reward allocations. After this period, allocations will be locked into the distribution smart contract, and no changes can be made. This structured approach ensures that both social contributors and active participants are rewarded fairly, promoting engagement within the ecosystem.

A crucial element of this distribution is the zkPass verification, which played a significant role in the success of the first phase by ensuring that rewards were given to genuine users, preventing abuse from bots and fake accounts. This verification process will be integral to all future IoTeX campaigns, emphasizing the commitment to prioritize real users. The Get Goated Season 2 aims to celebrate and reward the IoTeX community, providing real ownership in the decentralized infrastructure of the future while encouraging ongoing participation and engagement.

2 months ago

Top Five Cryptocurrency Gainers of the Week

In the past week, the cryptocurrency market has witnessed remarkable price surges among several tokens, with the top five gainers being VIRTUAL, MOODENG, OLAS, GOAT, and NOS. VIRTUAL led the pack with an impressive increase of 181%, rising from $0.15 to nearly $0.50. This surge is attributed to the involvement of Arete Capital, which is advising Virtuals Protocol on integrating AI agents into the economy. Additionally, the introduction of Luna, the first autonomous agent to employ humans on-chain, has further fueled interest in the token.

Following closely is MOODENG, which recorded a 165% price increase after the launch of the MOODENGUSDT Perpetual Contract on Binance Futures. The token's price surged from a stable range of $0.07 to $0.08, ultimately peaking at over $0.26. With a market cap exceeding $225 million, MOODENG has gained traction as a memecoin inspired by a viral baby hippo meme. Autonolas (OLAS) also saw significant gains of 92%, driven by the approval of its protocol deployment on ModeNetwork, which aims to scale DeFi through AI agents.

Other notable gainers include GOAT and NOS, which surged by 70% and 69%, respectively. GOAT's price rally was supported by the launch of futures trading on Binance, while NOS benefited from the launch of Fortress Deepyne, a project led by Nosana AI that aims to democratize access to GPU hardware for AI inference. Overall, these developments reflect a vibrant and rapidly evolving landscape in the cryptocurrency market, with innovative projects driving significant investor interest.

2 months ago

Solana's Remarkable Rebound: Price Surge and Ecosystem Developments

In the past week, Solana has experienced a significant rebound, with its price surging 12% to reach $140. This uptick in value comes amid renewed market optimism, spurred by the Trump administration's softened stance on tariff negotiations and the U.S. Federal Reserve's decision to maintain interest rates. The total value locked (TVL) in Solana's ecosystem has also risen to an impressive $72 billion, reflecting growing confidence among investors. Notably, Solana's stablecoin supply has hit record levels, surpassing $12.8 billion, indicating robust liquidity and adoption within the network.

In ecosystem developments, Pump.fun has launched its decentralized exchange (DEX), PumpSwap, which aims to streamline trading for Solana meme coins. This move has prompted Raydium to introduce LaunchLab, a platform designed to compete with Pump.fun and retain its market share. Additionally, Volatility Shares has debuted two funds tracking Solana futures, SOLZ and SOLT, providing investors with new avenues for exposure to the layer-1 network. As institutional interest grows, Fidelity has registered the "Fidelity Solana Fund," potentially paving the way for a Solana ETF, which could further enhance market dynamics.

Despite the positive trends, Solana's decentralized exchange volume has seen a decline, dropping 20% to $8.06 billion. However, the overall market sentiment remains bullish, with Solana outperforming its rivals, including Ethereum and Bitcoin. The ecosystem's market cap has increased by 10%, and daily active addresses have risen to over 3.8 million. As Solana continues to innovate and attract attention, the coming weeks will be crucial in determining its trajectory in the competitive blockchain landscape.

2 months ago

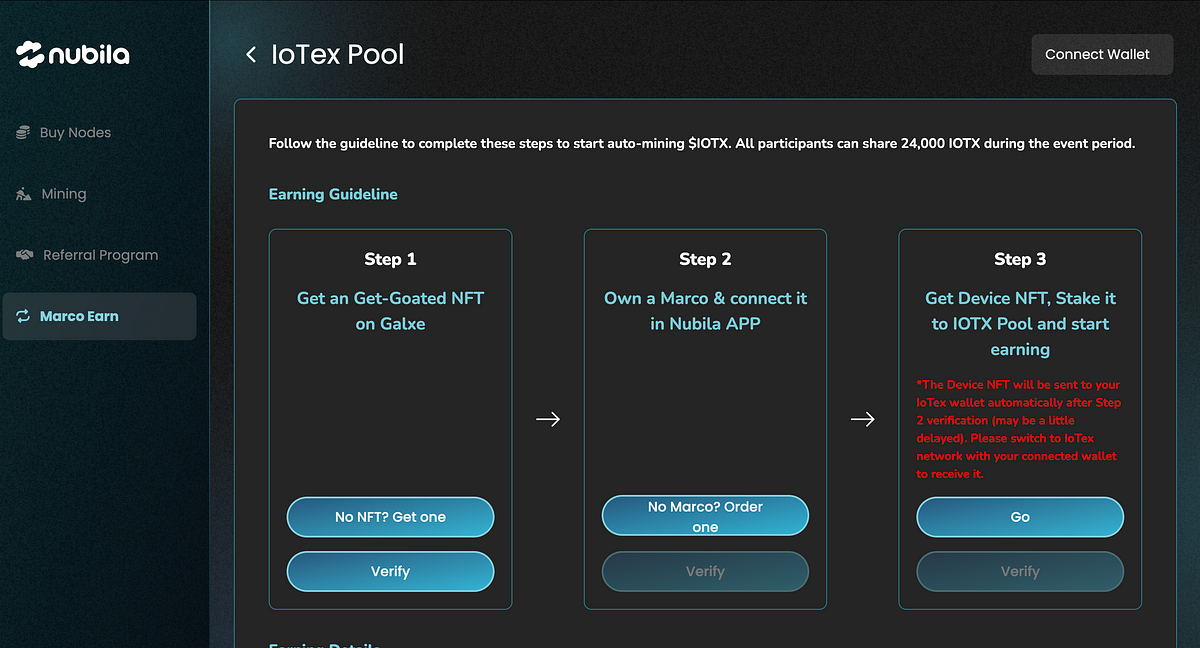

Nubila Launches Dual Mining Campaign for $IOTX with Marco Weather Stations

Nubila is at the forefront of a decentralized initiative aimed at collecting and rewarding real-time environmental data through its innovative Marco Weather Station, aligning with the broader DePIN movement. Participants in Nubila's Get Goated Season 2 campaign who own a Marco device can now engage in a Dual Mining Campaign. This program enables users to mine $IOTX, the native token of the IoTeX ecosystem, while also accumulating Nubila Mining Points, thereby incentivizing the collection of valuable environmental data.

To participate in the Dual Mining Campaign, users must meet specific eligibility requirements. Firstly, they need to own a Marco Weather Station and have it linked to the Nubila app, as the data collected from this device is essential for the mining process. Additionally, claiming the Nubila Get Goated Season 2 NFT, distributed via Galxe, is mandatory as it serves as an access pass for the dual mining activities. Once these prerequisites are fulfilled, participants can proceed to connect their wallets and verify their email addresses to confirm their ownership of the Marco device.

After verification, users can stake their Marco NFT in the IoTeX reward pool to activate dual mining. The process is designed to be user-friendly, with no gas fees required for transactions on the IoTeX interface. Nubila aims to create a decentralized environmental data network, utilizing AI to deliver accurate insights for industries sensitive to weather changes. This initiative not only promotes climate change awareness but also encourages sustainability through incentivized IoT devices, paving the way for a more informed and responsive approach to environmental challenges.

2 months ago

Roam: Pioneering the DePIN Track in Web3 Integration

In 2025, the DePIN track is emerging as a vital link between Web3 and real-world applications. According to the "DePIN Annual Report" by Messari, over 13 million DePIN devices are currently operational globally, contributing to infrastructure networks. Despite being in its infancy and representing less than 0.1% of the trillion-dollar terminal market, DePIN has attracted more than $350 million in early funding. As the on-chain battle intensifies in 2024, Solana is leading the charge in network infrastructure, while ROAM has gained significant traction with nearly 3 million WiFi nodes and 2.5 million users, showcasing its rapid growth and community engagement.

Roam's impressive expansion is attributed to its integration of OpenRoaming technology and blockchain DID/VC technology, alongside a business model that combines free eSIM services with token incentives. This approach not only broadens its wireless network reach but also facilitates user entry into the Web3 ecosystem, offering continuous income opportunities. The recent launch of the ROAM token on 12 exchanges, including Bybit and Bitget, saw a remarkable trading volume of $120 million on its first day, establishing it as a leader in decentralized wireless networks. Roam's unique dual deflationary economic model further enhances its revenue potential, shifting focus from supply-side growth to demand-side exploration.

Looking ahead, Roam is poised to solidify its position in the DePIN track through innovative applications and robust token economics. The upcoming use cases for ROAM tokens in gaming centers and credit card transactions will enhance user engagement and token consumption. With a total supply of 1 billion tokens and a strategic dual deflationary mechanism, Roam aims to create scarcity and drive long-term value. As it continues to expand its global open wireless network, Roam exemplifies the potential of decentralized technologies in shaping the future of connectivity and AI development, warranting close attention from the blockchain community.

2 months ago

GLIF Launches Governance Token GLF with Airdrop and Plans for Expansion

GLIF, the largest DeFi protocol on Filecoin, has officially launched its governance token, GLF, and is distributing 94 million tokens through an airdrop. This distribution represents 9.4% of the total GLF supply, rewarding users who have engaged with the protocol by accumulating GLIF points. Initially, GLIF had planned to allocate 100 million tokens for the airdrop, but adjusted the number based on user participation. The remaining tokens will be returned to the community rewards pool for future distribution. GLF is currently focused on governance, but the team is developing a loyalty program inspired by airline miles, which will eventually offer additional benefits to token holders.

As GLIF expands beyond Filecoin, it aims to support additional decentralized physical infrastructure networks (DePINs). The protocol allows FIL holders to earn rewards through liquid leasing, enabling them to lend tokens to Filecoin storage providers. These providers use FIL as collateral to offer storage services, and lenders receive rewards in return. Depositors in GLIF receive iFIL, a liquid leasing token that can be traded or utilized in other DeFi protocols while still generating yield. With over $102 million total value locked, GLIF has established itself as a dominant player in Filecoin's DeFi space and is now exploring similar systems for other DePINs.

GLIF's expansion strategy involves discussions with various protocol foundations, focusing on user demand, technical feasibility, and economic risks. Many of Filecoin's storage providers are also significant miners across DePIN networks, leading to a trend of optimizing hardware for multi-chain contributions. By integrating with networks already supported by these miners, GLIF anticipates rapid scaling. Additionally, the team is exploring DePIN networks outside of storage, including those in the energy sector, and is open to adjusting their model or introducing new protocols to accommodate these networks. This strategic expansion reflects GLIF's commitment to innovation and adaptability in the evolving DeFi landscape.

Signup for latest DePIN news and updates