Nubila Launches Dual Mining Campaign for $IOTX with Marco Weather Stations

Nubila is at the forefront of a decentralized initiative aimed at collecting and rewarding real-time environmental data through its innovative Marco Weather Station, aligning with the broader DePIN movement. Participants in Nubila’s Get Goated Season 2 campaign who own a Marco device can now engage in a Dual Mining Campaign. This program enables users to mine $IOTX, the native token of the IoTeX ecosystem, while also accumulating Nubila Mining Points, thereby incentivizing the collection of valuable environmental data.

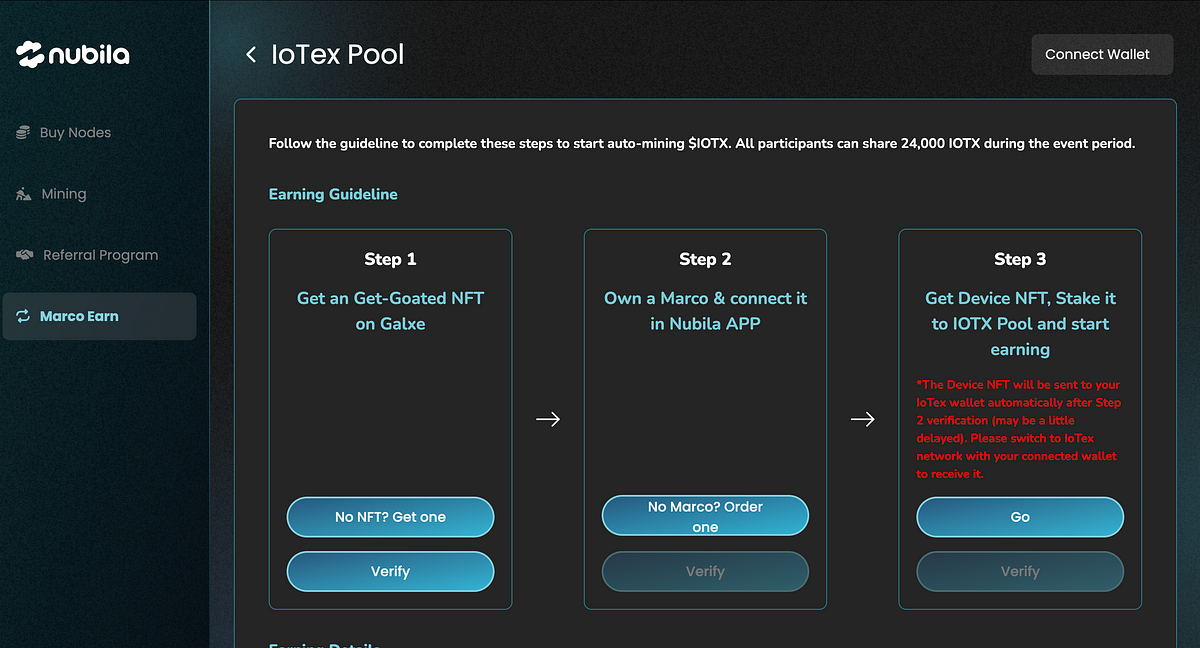

To participate in the Dual Mining Campaign, users must meet specific eligibility requirements. Firstly, they need to own a Marco Weather Station and have it linked to the Nubila app, as the data collected from this device is essential for the mining process. Additionally, claiming the Nubila Get Goated Season 2 NFT, distributed via Galxe, is mandatory as it serves as an access pass for the dual mining activities. Once these prerequisites are fulfilled, participants can proceed to connect their wallets and verify their email addresses to confirm their ownership of the Marco device.

After verification, users can stake their Marco NFT in the IoTeX reward pool to activate dual mining. The process is designed to be user-friendly, with no gas fees required for transactions on the IoTeX interface. Nubila aims to create a decentralized environmental data network, utilizing AI to deliver accurate insights for industries sensitive to weather changes. This initiative not only promotes climate change awareness but also encourages sustainability through incentivized IoT devices, paving the way for a more informed and responsive approach to environmental challenges.

Related News