Latest DePIN Funding News

6 months ago

Hivemapper Celebrates Two Years of Innovation and Growth

As the Hivemapper Network celebrates its second anniversary, it reflects on a remarkable year of growth and innovation. Launched two years ago, Hivemapper has become the fastest-growing mapping project globally, achieving an impressive 28% coverage of the world's roads—five times faster than Google Street View. Despite facing hardware shortages, the network has outpaced other crowdsourced mapping initiatives, attracting significant interest from major mapmakers and industries such as automotive and logistics. The rising demand has resulted in over 6 million HONEY tokens burned, showcasing the project's increasing utility and adoption.

The integration of AI into the mapping process has been another highlight, with Hivemapper's AI Trainer pipeline evolving into a robust data generation and validation system. This initiative has garnered attention from investors, who see the potential for AI Trainers as a standalone service. Marketing efforts have positioned Hivemapper at the forefront of Decentralized Physical Infrastructure (DePIN), with endorsements from notable entities like A16Z and Binance. The liquidity of HONEY tokens has improved significantly, with listings on major exchanges and a remarkable 50-fold increase in market cap since the project's inception, despite the challenges posed by a volatile crypto market.

Looking ahead, Hivemapper's roadmap for Year 3 is ambitious. The focus will be on expanding the HONEY economy, increasing map coverage, and enhancing customer engagement. Plans include launching next-generation dashcams, refining tokenomics, and fostering a developer ecosystem through grants and APIs. The network aims to innovate in consumer navigation and fleet intelligence while ensuring transparency and decentralization. As Hivemapper continues to evolve, it remains committed to its vision of a community-driven mapping future, encouraging contributions that will shape the landscape of geospatial services for years to come.

6 months ago

Grass Token Soars 125% Following Major Airdrop on Solana

The Solana-based decentralized physical infrastructure network (DePIN) project, Grass, has recently gained significant attention following its GRASS token airdrop on October 28. This governance token has seen an impressive price rally of 125% in just three days, with the current trading price at $1.82. The market capitalization has surged to $450 million, and daily trading volumes have exceeded $400 million, making it one of the trending cryptocurrencies this week. The airdrop was notable for being the largest within the Solana ecosystem, with nearly 1.5 million addresses participating, surpassing the previous record held by the decentralized exchange Jupiter.

One of the primary drivers behind the GRASS token's price surge is the anticipation of listings on Tier-1 exchanges. Additionally, the futures open interest for the token has increased by 73% to $90.33 million, while the daily trading volume for GRASS futures has jumped by 146% to $1.30 billion. The project itself is unique, featuring an open internet-scale web crawl that collects and validates data for AI training, rewarding users with GRASS tokens. Andrej Radonjic, CEO of Wynd Labs, emphasized that this project allows users to reclaim ownership of their bandwidth, a shift from traditional extractive models in the industry.

The GRASS token rally is supported by various market trends, including a resurgence in Token Generation Events (TGEs) and a shift in investor focus from meme coins to utility tokens. The DePIN sector continues to attract interest, and the evolving tokenomics of GRASS, which includes a 25% initial unlock, has proven effective in boosting momentum. Despite not being listed on Binance, GRASS has achieved nearly $500 million in trading volume, reflecting strong demand. The initial valuation strategy of starting lower has also contributed to community gains and market enthusiasm for the token.

6 months ago

Crypto Market Prepares for Potential Black Swan Events Ahead of U.S. Elections

As the U.S. election week approaches, the crypto market braces for potential surprises, often referred to as "black swan" events. Crypto analyst CryptoCapo TG has recently issued a warning on Telegram, suggesting that a rare and unpredictable event could occur just before the elections, potentially resulting in an average price drop of 35% for altcoins. He predicts that large-cap cryptocurrencies such as Ethereum, Binance Coin, and Solana may experience declines between 25% and 35%, while smaller-cap coins could face even steeper drops ranging from 40% to 60%. This anticipated downturn is described by CryptoCapo TG as a "final shakeout," aimed at eliminating less confident investors ahead of a possible altseason, where altcoins typically see significant gains.

Ripple executives have also weighed in on the potential for a black swan event. CEO Brad Garlinghouse believes that a sudden, game-changing disruption could impact the entire crypto sector, while co-founder Chris Larsen warns that a liquidity crisis might trigger widespread market ripples. Both executives expect that the next major event will catch the crypto community off guard and lead to unexpected changes. In contrast to the cautious outlook from CryptoCapo TG, analyst Lana Queen sees a silver lining, suggesting that the current bearish sentiment might pave the way for new all-time highs (ATHs). She believes that despite negative views from analysts like Capo and Jim Cramer, the market could be poised for a rally.

In light of this uncertain outlook, CryptoCapo TG advises investors to prepare mentally, diversify their portfolios, and consider a HODL strategy for long-term gains. Staying informed about macroeconomic trends and global events is essential, as these factors can significantly influence market sentiment. While there is a tangible risk of a substantial crypto downturn, it may also present an opportunity for investors to refine their strategies in anticipation of an altseason. With the current BTC dominance at 60% and increasing interest from presidential candidates in crypto assets, this year's black swan event could potentially favor altcoins, leading to a pivotal moment in the market's evolution.

6 months ago

Züs AMA Recap: Strategic Moves and Future Plans

In a recent AMA session, the team behind Züs expressed gratitude to participants for their insightful questions. A significant highlight was the announcement of the ZCN Buyback Plan, where the team intends to purchase ZCN from the market corresponding to each Vult or Blimp allocation bought in USD. This initiative aims to enhance the value of ZCN while also incentivizing users to engage with the platform through referrals. The introduction of USD rewards for Vult or Blimp referrals, particularly a 10% reward for Blimp referrals, is expected to further boost user participation and sales.

Additionally, the team provided an update on their recent advertising campaign, which, while successful in generating new leads, unfortunately led to a temporary app crash. The ads are currently paused as the team works diligently to resolve the issue and resume their marketing efforts. Excitingly, a new partnership has been secured, although specific details remain under wraps. The team is optimistic about ongoing discussions for more partnerships that could enhance their market presence.

Looking ahead, the focus remains on driving sales, forming strategic partnerships, and collaborating with influencers to amplify their reach. The team is also exploring promising funding leads to support their initiatives. Community engagement is encouraged, with a call for influencers to get involved in supporting Blimp sales. As Züs continues to innovate in the AI-ready distributed storage space, the community is eager to see how these strategic moves will unfold in the coming weeks.

6 months ago

Weekly Cryptocurrency Market Recap: Trends and Developments

The cryptocurrency market concluded the week with a market capitalization of $2.33 trillion, reflecting a slight decline of 0.45%. Trading volumes experienced a significant drop, with a 16.02% decrease in the 24-hour volume, which now stands at $80.78 billion. This downturn suggests a cautious sentiment among traders, as indicated by the Fear & Greed Index, which remained neutral at 57. Bitcoin, however, showed resilience, climbing 3.91% this week and inching closer to its all-time high of 59.01%. In contrast, Ethereum's growth was more modest, rising only 0.65% as traders awaited crucial network scaling updates. Solana faced a decline of 2.91%, mirroring the broader market trends, while XRP maintained a steady performance with minimal price fluctuations.

In notable developments, Crypto.com has overtaken Coinbase in trading volume within North America, highlighting its increasing appeal among traders. This shift underscores the intensifying competition among exchanges vying for dominance in the North American market. Additionally, BlockFills has launched a new crypto-to-fiat payment processing service designed for enterprises and FinTech firms, facilitating seamless cryptocurrency transactions and conversions to fiat currency. This innovation aims to meet the growing demand from major organizations seeking efficient payment solutions.

Furthermore, Visa has partnered with Coinbase to enable eligible debit card users in the U.S. and Europe to perform real-time cryptocurrency deposits and withdrawals, marking a significant advancement in institutional acceptance of digital currencies. Meanwhile, a recent incident involving Michael Saylor, executive chairman of MicroStrategy, sparked controversy when he tweeted a false statement attributed to Donald Trump regarding Bitcoin. This incident highlights the ongoing challenges of misinformation in the cryptocurrency space. On a positive note, the U.S. government successfully recovered $19.3 million from a recent cyberattack, showcasing improved capabilities in asset recovery and enhancing security confidence within the cryptocurrency industry.

6 months ago

Nansen and MetaStreet Unveil New Investment Opportunities in NodeFi and GPUfi

Nansen, a blockchain analytics platform, has released a new report in collaboration with yield infrastructure protocol MetaStreet, highlighting emerging opportunities for Web3 investors. The report focuses on decentralized physical infrastructure networks (DePIN), specifically node financing (NodeFi) and graphics processing unit financing (GPUfi). As artificial intelligence continues to drive demand for computing capacity, these areas are positioned to offer significant returns. The combination of NodeFi and GPUfi could yield between 30% to 200% through productive yield, token emissions, and decentralized finance (DeFi) trading, presenting a compelling alternative to traditional financial investments.

The report emphasizes that GPUfi allows investors to earn yields from GPU rentals, while nodes can provide regular token distributions. This innovative approach to financing could transform existing supply bottlenecks into lucrative investment opportunities. Tokenizing nodes and GPUs introduces benefits not typically available in traditional finance, such as lending, yield speculation, and self-repaying loans. However, the report also notes that there is currently limited on-chain liquidity and financing, although some projects, like Aethir's DePIN GPU-as-a-service, are making strides in this area.

Despite the potential for high returns, the report warns that setting up NodeFi and GPUfi involves complexities that may deter some investors. The process ranges from straightforward to ill-suited for on-chain implementation, with efficient execution being critical for success. Additionally, challenges such as accurate valuation, accounting, and navigating legal frameworks make these investments more intricate than traditional instruments like treasury bills. As the landscape of DePIN continues to evolve, it is clear that the intersection of AI and blockchain presents a wealth of opportunities for savvy investors.

6 months ago

Bitcoin ETFs Surpass 1 Million BTC Amid Industry Developments

This week, significant developments in the cryptocurrency space have captured investor attention, particularly the milestone of Bitcoin ETFs in the US surpassing 1 million BTC. This achievement signifies a growing acceptance of Bitcoin as a mainstream financial asset, with current holdings exceeding 1.18 million BTC, representing over 5.6% of the total supply. Notably, BlackRock's iShares Bitcoin Trust alone holds over 420,000 BTC. The surge in ETF holdings is seen as a positive indicator for Bitcoin's future, with analysts suggesting that a supply shock may be imminent as institutional interest continues to rise.

In addition to the ETF news, major Q3 earnings reports from companies like Tether, MicroStrategy, and Robinhood have also drawn attention. Tether reported record profits exceeding $2.5 billion, while MicroStrategy announced a substantial capital-raising initiative to acquire more Bitcoin over the next three years. Robinhood's trading volume surged by 114% year-over-year, reflecting the heightened investor enthusiasm for cryptocurrencies. These developments not only highlight the financial health of these companies but also underscore the growing integration of cryptocurrency within traditional financial markets.

However, the week was not without controversy, as allegations of insider trading surfaced against YouTube star MrBeast, claiming he profited significantly from undisclosed transactions. Meanwhile, concerns about potential market manipulation on Polymarket regarding betting odds for the 2024 presidential election were raised, with analyses suggesting that a significant portion of trading volume may have been artificially inflated. Additionally, a wave of layoffs across various crypto companies, including ConsenSys and Kraken, signals ongoing challenges within the industry. Despite these hurdles, the GRASS token's recent price surge following its airdrop event indicates that investor interest in innovative projects remains strong.

6 months ago

XYO Token Launches on Solana, Expanding Cross-Chain Accessibility

XYO, a decentralized physical infrastructure network (DePIN), has successfully bridged from Ethereum to Solana, marking a significant step in its mission to enhance cross-chain accessibility. As of October 31, the XYO token is now tradable against popular tokens such as Solana (SOL) and USD Coin (USDC) on Solana-native decentralized exchanges (DEXs) like Jupiter and Raydium. This move is aimed at leveraging Solana's high throughput, low transaction costs, and scalability, which are essential for the growing DeFi ecosystem. Markus Levin, co-founder of XYO, emphasized that this integration allows holders of Solana-based tokens to easily trade into and out of XYO, thus accessing its extensive DePIN data ecosystem.

The XYO network operates over 8 million nodes across 150 countries, providing a robust infrastructure for verifying location and other real-world data for both Web2 and Web3 projects. DePINs are designed to decentralize various real-world infrastructures, including communications, data storage, and energy markets. According to a report by MV Global, DePINs are poised to become a significant use case in the crypto space, potentially onboarding millions of new users. The current ecosystem includes over 1,000 projects with a combined market capitalization exceeding $50 billion, highlighting the growing interest and investment in this sector.

Solana's low median transaction fee of $0.00064 makes it an attractive platform for DePIN projects like XYO, Helium, and Render. Analysts believe that Solana's parallel processing architecture and low fees contribute to its appeal for future DePIN developments. With the anticipated Firedancer upgrade, experts expect Solana to further solidify its position as the preferred choice for upcoming DePIN projects, enhancing its infrastructure and user experience in the decentralized finance landscape.

6 months ago

Roam Launches Telecom Data Layer for Enhanced Global Connectivity

Roam is revolutionizing global wireless connectivity by transitioning from a standalone DePIN (Decentralized Physical Infrastructure Network) project into a comprehensive public platform known as the "Telecom Data Layer". This transformation is aimed at creating a seamless and intelligent ecosystem that bridges people, devices, data, and AI. The Roam Telecom Data Layer comprises four core modules: Roam Network, Roam Growth, Roam Discovery, and Roam Community. Together, these modules form a Blockchain of Things (BoT) ecosystem that enhances network vitality and fosters global expansion.

A standout feature of the Roam Network is its global open wireless network, which incentivizes users through tokens to contribute to network growth and node validation. This participation generates valuable geolocation and time-based data, forming the backbone of Roam's Telecom Data Layer. Users can easily engage with the network by downloading the Roam App, where they can add WiFi locations or check into existing nodes to earn Roam Points. Following the upcoming Token Generation Event (TGE), these points can be converted into $ROAM tokens, rewarding users for their contributions. Additionally, Roam offers specialized Roam Miner Router nodes that provide high-speed connectivity and blockchain mining capabilities, further driving decentralized infrastructure development.

Roam also emphasizes seamless and secure connectivity through its WiFi nodes, which include OpenRoaming™ nodes and self-build nodes. These nodes allow users to connect effortlessly across networks, eliminating the need for repeated logins. The introduction of Roam eSIM enhances global roaming capabilities, allowing users to activate services without a physical SIM card while ensuring data security and affordability. By integrating blockchain technology with real-world infrastructure, Roam is set to reshape global network collaboration, empowering users and developers alike in a new era of connectivity.

6 months ago

Exploring Passive Income Opportunities in DePIN Projects

Passive income is increasingly becoming a focal point for individuals looking to enhance their financial stability. One promising avenue is Decentralized Physical Infrastructure Networks (DePIN), which allows users to earn rewards through decentralized systems without significant initial investment. The primary objective of DePIN is to create a decentralized infrastructure that utilizes blockchain technology to support hardware services. This innovative approach not only facilitates income generation but also incentivizes participation through token rewards, making it an attractive option for those with limited capital.

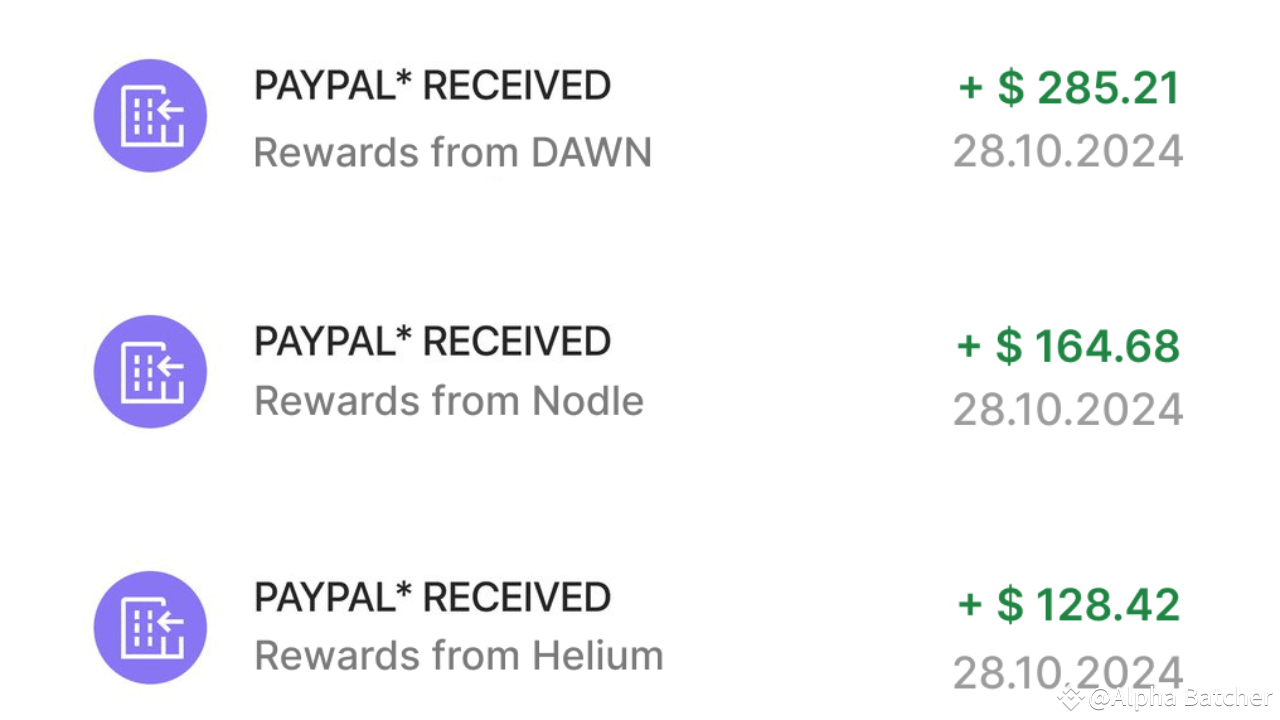

Among the various DePIN projects, @helium_mobile stands out as a rapidly expanding wireless network that rewards users for sharing their geolocation data with $MOBILE tokens. Users can potentially earn around $700 monthly by purchasing and installing a Helium HotSpot device. Similarly, @dawninternet offers a decentralized wireless network where users can earn approximately $150 per month by downloading an extension and creating an account. Another noteworthy project, @NodleNetwork, utilizes smartphones to provide services, allowing users to earn about $200 monthly by simply downloading an app and enabling Bluetooth.

Additionally, @Hivemapper presents an opportunity to earn around $800 monthly through a decentralized mapping network by installing a camera in your vehicle. Other projects like @HivelloOfficial and @Gradient_HQ also offer substantial earning potential, with users able to earn $200 monthly by providing computer resources or participating in decentralized cloud computing. Overall, DePIN represents a promising sector for passive income, combining safety and minimal time investment, making it an appealing choice for aspiring earners in the blockchain space.

Signup for latest DePIN news and updates