The DePIN Explorer - DePIN Scan

Trending 🔥

DePIN Market Cap

$33,791,404,621

+1.4%

Volume

$6,662,588,516

-3.6%

DePIN Projects

295

DePIN Devices

19,711,497

DePIN Projects

DePIN Scan is the explorer for DePIN crypto projects. There are 295 DePIN Projects with a combined DePIN market cap of $33,791,404,621 and total DePIN devices of 19,711,497. Click into the projects below to learn how to start earning passive income today.

Project | Token | Category | Social Following | Market Cap | Token Price | 24h Trade VOL | 1D | 7D | 30D | Total Devices | Favorites | Last 7 days |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SOL | Chain | 2,983,977 | $103,097,601,794 | $213.68 | $3,031,598,422 | -1.1% | +11.4% | -10.5% | - | 4 | |

| FIL | Server | 667,158 | $3,585,852,194 | $5.8 | $260,086,304 | +2.9% | +16.1% | -29.7% | 3,583 | 2 | |

| THETA | ServerAI | 272,081 | $2,436,341,245 | $2.44 | $24,579,562 | -2.2% | +2.8% | -20.4% | 5,885 | 2 | |

| HNT | Wireless | 215,970 | $1,170,302,285 | $6.66 | $9,737,292 | -3.6% | +0.3% | -25.7% | - | 2 | |

| AKT | ServerAI | 121,321 | $851,005,270 | $3.44 | $11,231,042 | -2.9% | +16.1% | -28.4% | 472 | 1 | |

.jpg) | GRASS | ComputeAI | 529,819 | $748,707,771 | $3.08 | $92,889,650 | +0.1% | +30.1% | +1.4% | - | 6 | |

.jpg) | IO | ComputeAI | 512,187 | $513,875,778 | $4 | $146,737,517 | +4.1% | +35.6% | +6.3% | - | 0 | |

| PEAQ | Chain | 284,813 | $439,642,227 | $0.6708 | $55,287,886 | +4.2% | +28.9% | +39.1% | - | 4 | |

| ATH | Compute | 843,871 | $411,760,435 | $0.07254 | $33,165,301 | -2.0% | +12.9% | -12.2% | - | 0 | |

| IOTX | Chain | 327,853 | $396,604,738 | $0.04205 | $13,154,707 | +0.1% | +7.6% | -30.8% | - | 35 | |

.jpg) | NOS | ComputeAI | 60,956 | $299,136,098 | $3.6 | $4,228,565 | -7.5% | +38.5% | -11.8% | - | 1 | |

| HONEY | SensorAI | 50,652 | $269,512,924 | $0.08657 | $973,547 | -1.1% | -4.6% | -25.7% | 8,037 | 0 |

a day ago

Titan Network's Transformative Year: Milestones and Innovations in 20242024 has been a transformative year for the Titan Network, characterized by significant testnet launches, global events, and a rapidly expanding community across over 130 countries. The year kicked off with the Huygens Testnet, which ran from March 11 to April 22, achieving remarkable milestones such as 129,629 nodes and 642 TB of storage provisioned. This testnet aimed to enhance decentralized computing and storage, introducing points-based incentives for users to contribute idle resources, optimizing scheduling systems, and deploying smart contracts to improve transparency and trust within the network. Following this, the Herschel Testnet showcased further advancements, including the integration of WASM/JS environments and a Titan Test Chain based on the Cosmos SDK, which significantly broadened Titan's commercial capabilities.

The Cassini Testnet, launched on June 28, 2024, continued the legacy of exploration, introducing a Layer 1 public chain utilizing a DPoS consensus mechanism. This testnet aimed to enhance user engagement through new wallet functions and a rental-based incentive model for nodes. Throughout the year, Titan Network participated in numerous global events, including the Web3 Summit in Dubai and the Singapore FinTech Festival, where they received the Silver Partner Award for contributions to Web3 innovation. These events provided platforms for Titan to showcase its decentralized infrastructure solutions and engage with industry leaders, further solidifying its presence in the blockchain space.

As the year concludes, Titan Network has made significant strides in decentralized infrastructure, launching a mobile application and enhancing Titan Storage. The successful seed round fundraising led by Arrington Capital has fueled further innovations, while strategic partnerships with organizations like SFT Protocol and Filecoin Station have strengthened its ecosystem. Looking ahead, Titan Network is poised to continue its mission of building a more inclusive Web3 ecosystem, with gratitude to all participants who contributed to its journey in 2024. The future looks promising as Titan Network aims to push the boundaries of decentralized technology even further.

3 days ago

Solana's Resurgence: A Leader in Decentralized FinanceSolana has emerged as a leading player in the decentralized finance (DeFi) ecosystem, showcasing a remarkable recovery since the FTX exchange downfall in 2021. By 2024, Solana has solidified its position as one of the most popular blockchain networks, hosting a multi-billion dollar total value locked (TVL) and supporting a vast array of decentralized applications (dApps). The network is celebrated for its scalability, speed, and low transaction costs, making it an attractive platform for various projects, including lending, liquid staking, decentralized exchanges (DEXs), and non-fungible tokens (NFTs).

Among the standout projects on Solana, Phantom Wallet has become the largest self-custody wallet, facilitating safe cryptocurrency storage for millions of users. Jupiter, the top DEX on Solana, has gained traction with features like limit orders and dollar-cost averaging, while Marinade Finance leads in lending with its innovative liquid staking model. Magic Eden has established itself as the go-to NFT marketplace, and the meme coin Dogwifhat has captured significant attention in the crypto community. Other notable projects include Render Network, which focuses on decentralized GPU cloud rendering, and Ondo Finance, which tokenizes real-world assets to enhance liquidity and efficiency.

The importance of decentralized exchanges within the Solana ecosystem cannot be overstated, as they drive economic growth and uphold the principles of decentralized finance. As Solana continues to attract innovative projects and a growing user base, its resilience and adaptability in the face of challenges position it as a formidable player in the blockchain space. With billions in TVL and a diverse range of applications, Solana's DeFi ecosystem is poised for further expansion and success in the coming years.

3 days ago

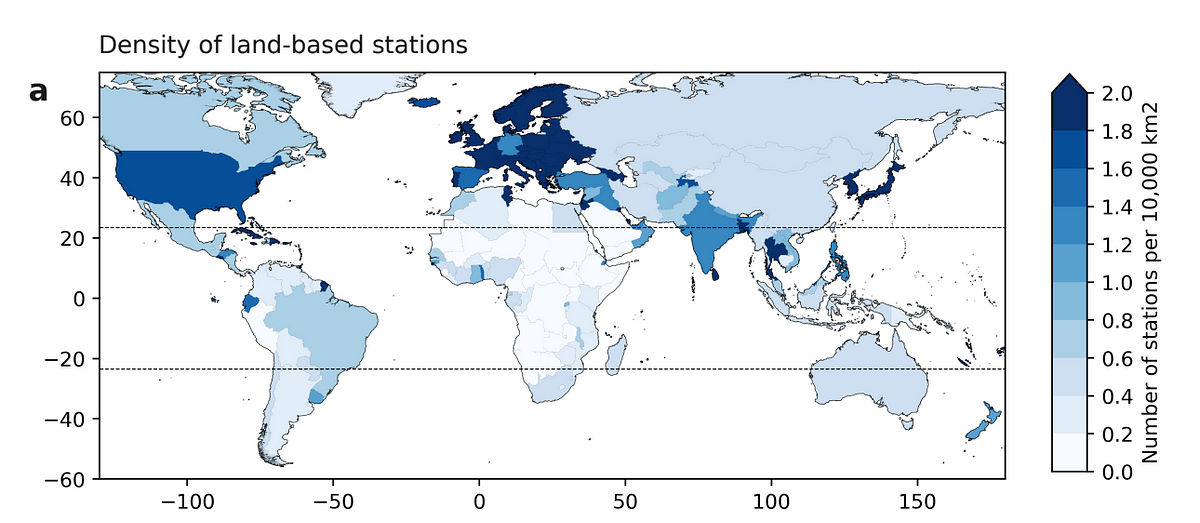

WeatherXM: Disrupting the Weather Data Industry in 2025As we move into 2025, WeatherXM is poised to transform the weather data industry, which has seen significant growth due to increasing demand from various sectors such as agriculture, aviation, and energy. The global market for weather information technologies was valued at approximately USD 9.41 billion in 2019 and is projected to reach USD 17.78 billion by 2027. This growth is fueled by the need for specialized weather services, with companies like The Weather Company and AccuWeather generating substantial revenues. However, the traditional weather data landscape is dominated by government organizations that operate extensive networks of weather stations, which are often costly and limited in deployment capabilities.

WeatherXM aims to disrupt this model by leveraging a more capital-efficient approach to weather station deployment. By utilizing a decentralized network of individual station owners and advanced software, WeatherXM can deploy thousands of weather stations at a fraction of the cost of traditional systems. This innovative model not only enhances the speed of deployment but also allows for the collection of high-quality data from diverse locations. The company has already deployed 7,000 stations in just two years, demonstrating its potential to scale rapidly compared to government-operated networks.

Despite its promising model, WeatherXM faces several challenges, including expanding network size, reaching underserved areas, and capturing the value of its data. The company plans to address these challenges through targeted rollout programs in developing regions, which will enhance weather infrastructure and unlock new economic opportunities. Additionally, WeatherXM is focused on proving the market fit of its data through initiatives like WeatherXM Pro and participation in parametric insurance pilots. As it continues to grow, WeatherXM is well-positioned to provide accessible and reliable weather information, catering to sectors that increasingly rely on accurate weather insights.

3 days ago

DIMO Ignite Grants Program: Fueling Innovation in the EcosystemThe DIMO Ignite Grants Program has been launched to enhance the DIMO ecosystem by providing milestone-based funding to developers creating infrastructure and applications that improve the platform's utility and scalability. The program aims to attract builders who may lack capital and encourages open-source contributions, thereby fostering resilience within the DIMO network. The initiative emphasizes efficiency, aiming for a swift review process of 2-3 weeks for grant applications, with payments arranged within a week upon milestone completion.

The grant program categorizes funding into several areas, including application developers, hardware product development, and data integrators. Developers can receive Data Credits to cover costs associated with using the DIMO Protocol, as well as retroactive grants for successful app launches. Specific bounties are also available for innovative applications, such as a vehicle NFT sharing social network or a trip tracking app, with rewards ranging from $20,000 to $15,000. Additionally, DIMO builders can benefit from incentives offered by Base, a low-cost Ethereum layer 2 incubated by Coinbase, which includes opportunities for seed investment and retroactive funding.

DIMO is committed to decentralization and enhancing its developer tools, encouraging contributions that expand the platform's capabilities. The program is not an investment fund, and its success will be measured by the growth and resilience of the DIMO network rather than traditional ROI metrics. By broadening the pool of vehicles and data sources, DIMO aims to increase accessibility for drivers and value for app developers, ultimately enriching the connected car experience and beyond. The Ignite Grants Program represents a significant step towards realizing these goals, fostering a vibrant community of developers and innovators within the DIMO ecosystem.

Signup for latest DePIN news and updates

.png)