Latest DePIN News

4 months ago

NodeOps Network is ranked 4th Globally in DePIN Sector

https://crypto.news/nodeops-ranks-4th-in-depin-revenue-amid-platform-rebrand/

4 months ago

WeatherXM Introduces 'Know Your Station' Feature for Enhanced Weather Data Quality

WeatherXM is set to enhance its mobile app with a new feature called "Know Your Station," aimed at ensuring the proper deployment of weather stations. This feature is part of a series of updates, including Cell forecast, Forecast Accuracy Tracking, and Hyperlocal Station Forecasts, which are designed to improve data quality and user experience. The Know Your Station feature will help users verify that their weather stations are installed correctly from the outset, thereby preventing potential issues that could compromise data integrity and user rewards.

The verification process for Know Your Station is user-friendly and conducted through the WeatherXM Pro mobile app. Upon accessing the feature, users will be greeted with an introductory instructions screen, which may be skipped if the user has previously accepted the terms. Users will then be prompted to submit photographs of their weather station installation from various angles. This process includes guidance through examples of correct and incorrect installations, ensuring users understand the optimal setup before uploading their images for evaluation. This functionality aims to minimize the chances of faulty or misleading weather data by confirming that stations are installed in ideal locations, free from obstructions and securely mounted.

The importance of the Know Your Station feature cannot be overstated, as poorly installed weather stations can lead to inconsistent or inaccurate readings, undermining the overall value of WeatherXM’s data. By providing users with the necessary guidance for proper setup from day one, WeatherXM aims to maintain the reliability of its network, which currently boasts a health rating of 90%. As the Know Your Station feature is set to launch soon, users are encouraged to explore WeatherXM Pro to fully leverage the benefits of accurate weather data in their operations.

4 months ago

Fetch.AI Launches Smart Contract for IBC CUDOS Reclamation

Fetch.AI has launched a smart contract today, February 12, aimed at helping users reclaim their IBC CUDOS tokens. This development is a significant step in enhancing cross-chain asset management and showcases the ongoing collaboration between Fetch.AI and CUDOS as part of the ASI Alliance. The new smart contract addresses the issue faced by several CUDOS holders who were unable to return their tokens to the CUDOS blockchain before it ceased operations. By utilizing this contract, users can swap their stranded CUDOS for Fetch.AI's FET tokens at a fixed ratio of 118.344, simplifying the process significantly.

The smart contract offers a user-friendly interface that eliminates the complex manual steps traditionally associated with CosmWasm contract interactions. Users can reclaim their tokens with a single click within the ASI chain, benefiting from automatic conversion at a transparent rate. This functionality is integrated into Fetch.AI's Companion dApp, which enhances the user experience within the ASI ecosystem. To reclaim their IBC CUDOS, users must transfer their tokens from Archway or Osmosis to the ASI chain, connect their ASI wallet, and execute the reclaim process, which will automatically convert their tokens to FET.

The collaboration between Fetch.AI and CUDOS is part of a broader initiative to democratize cloud computing and promote decentralized solutions that challenge the dominance of major tech companies. The ASI Alliance, which includes partners like Ocean Protocol and SingularityNET, is committed to advancing decentralized compute solutions. As part of this initiative, Fetch.AI will provide detailed instructions and documentation on their dApp on February 13, further facilitating the reclamation process for users and enhancing the overall decentralized computing landscape.

4 months ago

Launch of the Lit Python SDK Enhances Web3 Development

The Lit Python SDK has officially launched, providing developers with a powerful tool to integrate Lit Protocol into their Python applications. This new SDK simplifies access to Lit's decentralized encryption, signing, and compute functionalities, paving the way for the development of more versatile and secure Web3 applications. Alongside the SDK, a Python adaptation of the Lit Agent Wallet has also been released, further enhancing the toolkit available to developers.

With the Lit Python SDK and the Agent Wallet Python SDK, developers can now perform a variety of tasks including secure encryption and decryption of content, programmable key pair (PKP) generation, and message signing. The SDK allows for the execution of Lit Actions, which can automate interactions and fetch off-chain data, among other use cases. The installation process is straightforward, requiring only a simple pip command to get started, making it accessible for developers looking to enhance their applications with Lit's capabilities.

Looking ahead, the Lit team is committed to expanding the functionality of the Python SDK and optimizing its performance. They encourage developers to engage with the community for feedback and ideas, as well as to stay updated on new developments. With resources such as developer documentation, guides, and code examples available, the Lit Python SDK is set to empower developers in building innovative Web3 solutions with enhanced security and functionality.

4 months ago

Hivello Launches $HVLO Token on Raydium, Expanding Decentralized Opportunities

Hivello, a decentralized physical infrastructure network (DePIN) aggregator, has officially launched its $HVLO token on Raydium, following successful listings on MEXC and Gate.io. This launch, which took place on February 12th, 2025, at 11:00 AM UTC, marks a significant step in Hivello's mission to promote decentralization and accessibility in the blockchain space. The HVLO token is designed to empower users within Hivello's ecosystem, facilitating rewards, staking, and participation in various DePIN networks. By utilizing Raydium, a decentralized exchange on the Solana blockchain, Hivello aims to broaden the reach of its token, making it available to a larger audience.

The launch of the $HVLO token on multiple exchanges offers numerous benefits to users. Staking $HVLO through Hivello's platform can yield an impressive annual percentage yield (APY) of 88%, encouraging user participation in decentralized compute mining. This initiative not only enhances the utility of the token but also fosters a more engaged community. Hivello is committed to expanding its partnerships with DePIN protocols and AI compute networks, which will further drive the adoption of decentralized infrastructure and create more opportunities for users to earn rewards.

Co-Founder Dom Carosa expressed enthusiasm about the launch, emphasizing the importance of providing a decentralized trading option for the community. As Hivello continues to scale its network of decentralized node operators, it aims to simplify the process for users globally to contribute to DePIN. With a focus on accessibility and education, Hivello is dedicated to making decentralized technology more understandable and beneficial for everyone involved in the ecosystem.

4 months ago

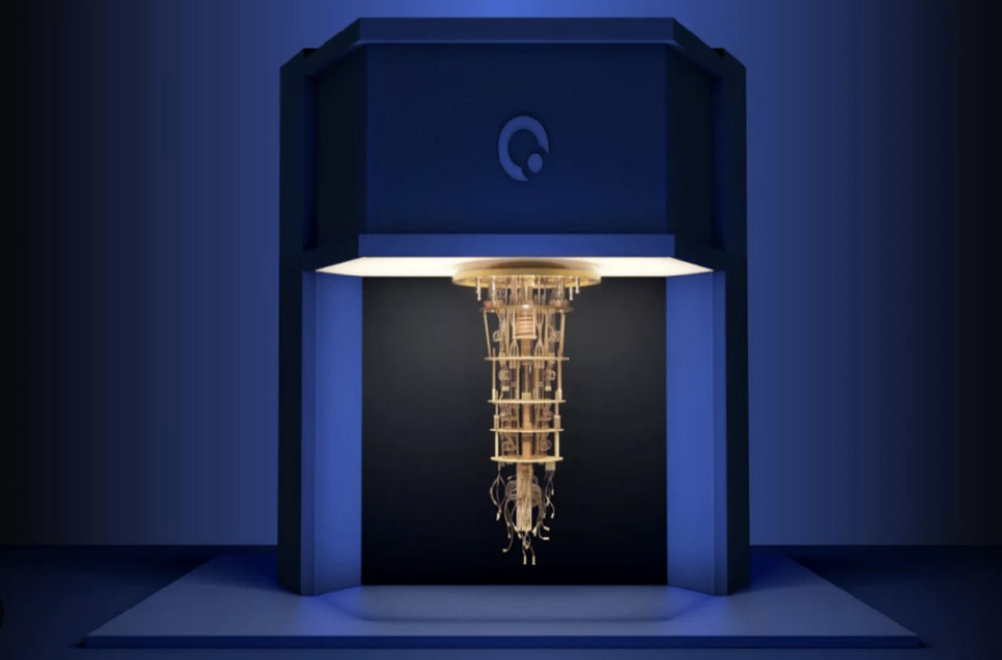

Phoenix Partners with Origin Quantum to Democratize Quantum Computing

Phoenix has announced a strategic partnership with Origin Quantum, a leading quantum computing firm in China, to integrate its 72-qubit superconducting quantum chip into a decentralized AI and compute network. This collaboration aims to democratize access to quantum computing, making it more accessible to a broader audience. By leveraging Origin Quantum's advanced technology, Phoenix plans to create virtualized nodes that will deliver quantum computing capabilities in a simplified API format and through a quantum compute terminal, significantly reducing costs and complexity associated with deployment and development.

The foundation of this partnership lies in Origin Quantum's latest superconducting quantum computer, known as "Origin Wukong," which boasts 72 working qubits and 126 coupler qubits. This technology is already operational and has been applied in various fields, including biosciences, material engineering, and quantum machine learning. Notably, the latest advancements in quantum AI have seen implementations of deep neural networks on Origin's quantum computers, marking a significant step forward in the integration of AI and quantum technologies.

To further enhance accessibility, Phoenix is developing QuantumVM, a web-based quantum computing platform that will allow users to run quantum applications without the need for coding expertise. This initiative is expected to launch in early Q2 2025, providing researchers and developers with the tools to create and execute quantum functions easily. Tiger Li, Ecosystem Head of Phoenix, emphasized the importance of this partnership, stating that it represents a novel approach to computing and aims to combine cutting-edge technology with practical applications in both AI and quantum fields.

4 months ago

Sogang University Joins EdgeCloud Network to Advance AI Research

EdgeCloud has recently welcomed Sogang University’s Language & Data Intelligence Laboratory, led by Professor Buru Chang, as its latest customer. This addition expands EdgeCloud's network to twenty clients across various sectors, including academia, enterprise, esports, and traditional sports. Sogang University, recognized as one of South Korea's premier AI research institutions, joins an esteemed group of academic partners such as Seoul National University, KAIST, Korea University, and Yonsei University. These institutions are leveraging Theta EdgeCloud's hybrid cloud-edge GPU computing platform to tackle challenges in AI training and inference.

Professor Buru Chang, an Assistant Professor in the Department of Artificial Intelligence at Sogang University, leads the Language & Data Intelligence Laboratory, which specializes in natural language processing (NLP), multimodal machine learning, and data mining. Dr. Chang holds a Ph.D. in Computer Science from Korea University and has previously worked as a machine learning research scientist at Hyperconnect. Under his guidance, the lab has gained significant recognition, contributing to leading AI conferences and focusing on innovative areas such as dialogue generation and multimodal AI applications. Professor Chang expressed enthusiasm about using the EdgeCloud platform, noting its ease of use and scalability, which will enable the lab to explore new frontiers in AI research.

With access to Theta EdgeCloud, the Language & Data Intelligence Laboratory aims to enhance its research capabilities in several key areas. These include advancing models for open-domain dialogue and semantic diversity in NLP, developing real-time AI solutions for media processing, and improving the efficiency of AI workflows through Theta’s hybrid GPU infrastructure. The collaboration signifies a promising step forward in AI research, as the lab looks to harness scalable and cost-effective computing power to drive innovation and address complex challenges in the field.

4 months ago

Helium Faces Price Challenges Amid Market Fluctuations

Helium (HNT) has been experiencing significant price fluctuations, recently needing to close above $4.24 to establish a bullish market structure. After a steep decline of 68.5% from its December resistance level of $9.54, Helium retested the psychological support level of $3 last week. This drastic drop in price over just two months indicates a challenging market environment, with the $3.3 zone now emerging as the next bearish target due to a lack of strong buying momentum and a persistent downtrend since December.

Despite a recent bounce to $4.18, Helium has yet to break its downtrend, although there are signs of weakening bearish momentum. A notable bullish divergence occurred in early February, where the price made lower lows while the Relative Strength Index (RSI) recorded higher lows. This divergence led to a bounce from the $3 support level, resulting in a 28.5% price increase within a week. However, this rally was not supported by strong buying volume, as indicated by the Accumulation/Distribution (A/D) indicator, which has been on a downtrend since mid-December.

The market has shown a large liquidity cluster around the $3.6 mark, which was tested recently, resulting in a quick price jump to $4.19. Following this spike, volatility has decreased, and HNT has consolidated below the $4 level. Traders should prepare for a potential range formation between $3.3 and $4.2-$4.5 in the coming days, with the $3.6 zone likely acting as a barrier to further bearish movements. Overall, the market remains cautious as it navigates these price levels.

4 months ago

Democratizing Quantum Computing: The Phoenix and Origin Quantum Partnership

A groundbreaking collaboration is underway between Phoenix, a leader in decentralized artificial intelligence, and Origin Quantum, a pioneer in quantum computing. This partnership aims to transform quantum computing from a complex and esoteric field into a practical tool that is accessible to everyday technologists. By integrating Origin Quantum's 72-qubit superconducting chip into Phoenix's DePIN network, the collaboration seeks to unlock powerful computational capabilities, making advanced quantum applications as easy to use as mobile apps. This integration promises to simplify the complexities of quantum systems, allowing users to harness their potential without needing specialized knowledge.

At the heart of this initiative is Origin Quantum's "Wukong" quantum computer, which boasts 198 qubits and is designed to tackle real-world challenges across various fields, including biosciences, material engineering, and artificial intelligence. The technology is already making waves in industries, providing live solutions that enhance processes from quantum biosciences to smart manufacturing optimizations. Complementing this is the upcoming launch of QuantumVM, an intuitive platform set to debut in early Q2 2025. QuantumVM will empower users to execute quantum computations through a user-friendly web interface, significantly reducing technical barriers and costs associated with quantum technology.

The implications of this partnership extend far beyond mere accessibility. As quantum computing continues to evolve, it is projected to revolutionize industries such as healthcare, finance, and logistics by optimizing complex systems and processes. Moreover, the democratization of quantum technology is crucial for fostering innovation, enabling smaller companies and independent developers to contribute to advancements in technology. This collaboration between Phoenix and Origin Quantum is not just about making quantum computing accessible; it is about reshaping the digital landscape and paving the way for a future where the impossible becomes routine.

Signup for latest DePIN news and updates