Zuvu AI and Vana Partner to Enhance Decentralized AI in Bittensor

On February 26, Zuvu AI and Vana announced a strategic partnership aimed at enhancing decentralized artificial intelligence within the Bittensor ecosystem. This collaboration seeks to create a more open and financially sustainable AI environment by integrating various layers of the decentralized AI stack. Zuvu AI, formerly known as SocialTensor, brings valuable experience from scaling four Bittensor (TAO) subnets, while Vana contributes its innovative user-owned data network, recently advised by Binance founder Changpeng Zhao. Together, they aim to test a new model of AI development that emphasizes collaboration and sustainability.

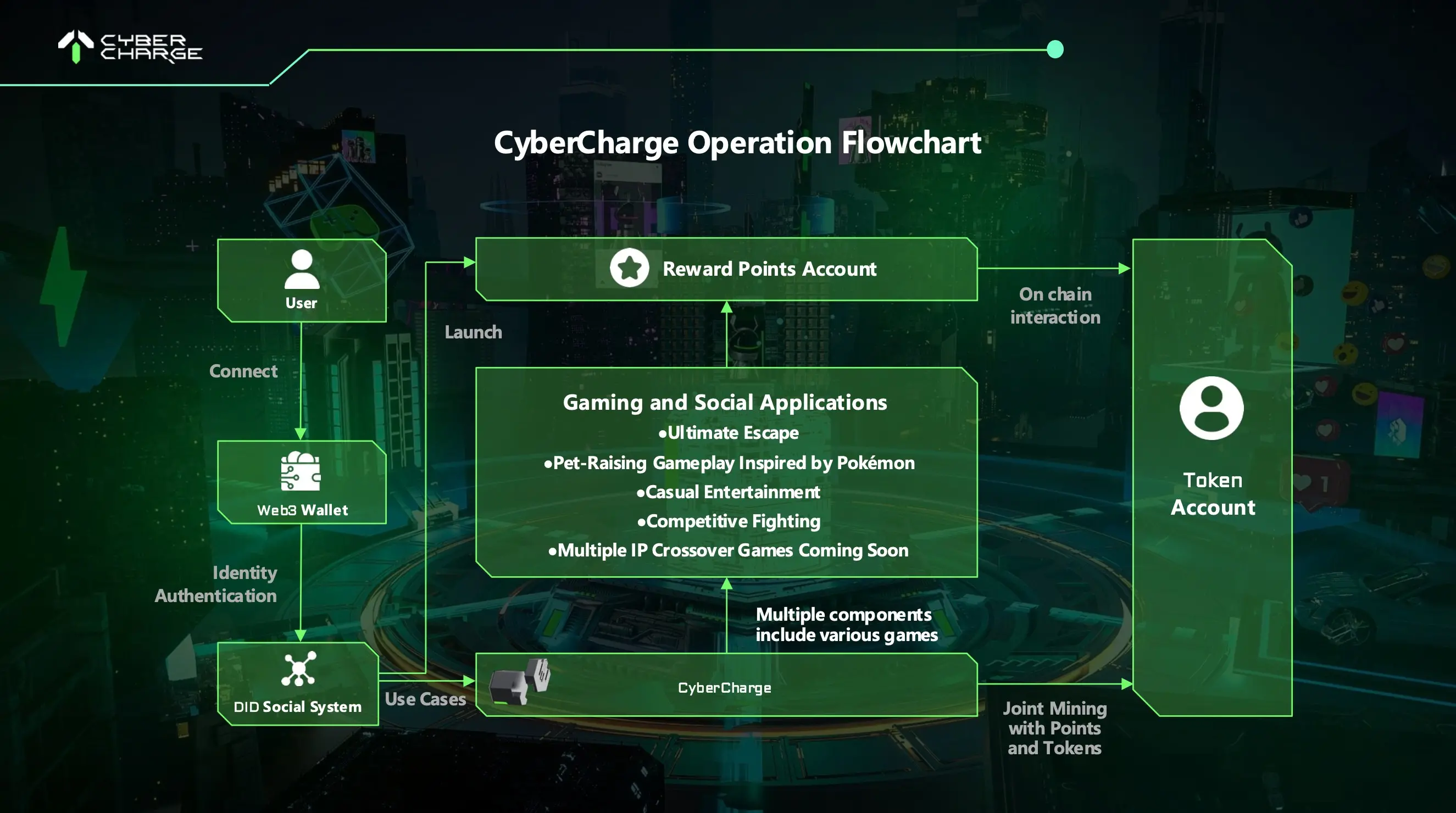

Art Abal, Managing Director at Vana Foundation, highlighted that the partnership effectively integrates Vana’s data layer, Bittensor’s subnet network, and Zuvu’s economic layer to enhance Vana’s DataDAO ecosystem. This integration addresses significant challenges in AI development by allowing models, agents, and data to be invested in, staked, traded, and monetized. With the AI market projected to reach trillions by 2032, this collaboration positions itself to create new opportunities in a rapidly expanding market, as Zuvu powers the AI economy layer.

The partnership’s strategic integration into Bittensor leverages its incentive-driven network to scale AI development effectively. By merging user-owned data with permissionless computing and economic incentives, this collaboration reflects the disruptive nature of decentralized finance (DeFi) in traditional finance. The partnership is expected to enhance the diversity of Bittensor’s subnets, support the expansion of Vana’s DataDAO, and establish Zuvu as a leader in AI financialization, potentially influencing industry practices. This initiative aligns with the growing trend toward open-source artificial intelligence and responds to the demand for alternatives to centralized AI giants.

Related News