Trump Family's Crypto Venture Raises Concerns Amid Political Scrutiny

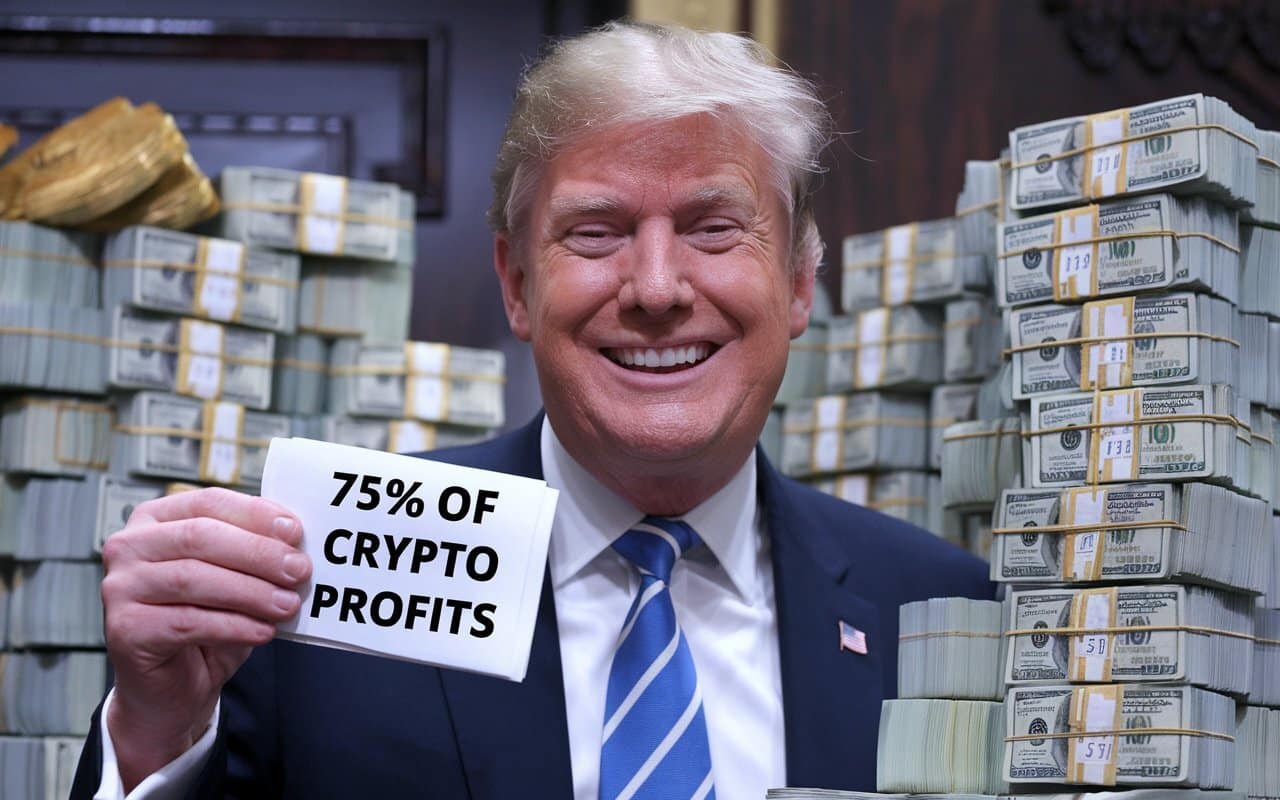

Donald Trump’s family-run crypto venture, World Liberty Financial, has recently come under scrutiny following the release of a 13-page document detailing its goals and token allocation. The ‘World Liberty Gold Paper’ reveals that the Trump family will receive a staggering 22.5 billion non-transferrable governance tokens ($WLFI) and 75% of the net protocol revenues. This allocation raises eyebrows among investors and supporters, as it suggests a potential profit of $337.5 million for the Trump clan, assuming a token price of 1.5 cents. Critics are concerned about the vagueness of the token allocations and the fact that these terms are subject to change, leading to accusations of possible scams.

Despite the ambitious goals of World Liberty Financial to challenge traditional banking systems and provide users with more financial freedom, the initial response to the $WLFI token has been tepid. Since its launch, only 917.80 million tokens, worth approximately $137,000, have been sold out of the 20 billion available. This lack of demand indicates that many investors, including Trump supporters, may be skeptical about the platform’s sustainability. Furthermore, the Gold Paper explicitly states that neither Trump nor his family holds any legal responsibilities regarding $WLFI or the venture itself, which adds another layer of concern for potential investors.

In addition to the controversies surrounding Trump’s crypto project, Vice President Kamala Harris has also faced criticism for her proposed crypto regulations, which appear to focus exclusively on black men. Her announcement has sparked mixed reactions, with some praising her openness to crypto while others argue that her approach is discriminatory. JD Vance, Trump’s potential running mate, has countered Harris’s stance, asserting that all individuals, regardless of race, desire the same opportunities in the crypto space. The juxtaposition of these two political figures highlights the ongoing need for equitable regulations in the US crypto market, free from self-serving agendas.

Related News