Hivemapper慶祝兩年的創新與成長

星期日, 十一月 3, 2024 12:00 凌晨

141

隨著Hivemapper網絡慶祝其成立兩周年,它回顧了一個卓越的增長與創新之年。Hivemapper於兩年前推出,已成為全球增長最快的地圖項目,實現了全球道路28%的覆蓋率—比Google街景快五倍。儘管面臨硬體短缺的挑戰,該網絡仍超越了其他眾包地圖計劃,吸引了主要地圖製作商及汽車和物流等行業的重大關注。需求的上升導致超過600萬個HONEY代幣被銷毀,顯示出該項目的實用性和採用率不斷增加。

將AI整合進地圖製作過程也是另一個亮點,Hivemapper的AI訓練管道發展成為一個強大的數據生成和驗證系統。這一舉措引起了投資者的注意,他們看到了AI訓練師作為獨立服務的潛力。市場營銷工作使Hivemapper站在去中心化實體基礎設施(DePIN)的前沿,並獲得了A16Z和Binance等知名實體的支持。HONEY代幣的流動性顯著改善,並在主要交易所上市,自項目啟動以來市場價值驚人地增長了50倍,儘管面對波動的加密市場帶來的挑戰。

展望未來,Hivemapper的第三年路線圖充滿雄心。重點將放在擴大HONEY經濟、增加地圖覆蓋率和提升客戶參與度。計劃包括推出下一代行車記錄儀、完善代幣經濟學,並通過資助和API促進開發者生態系統。該網絡旨在在消費者導航和車隊智能方面進行創新,同時確保透明度和去中心化。隨著Hivemapper的不斷發展,它仍然致力於其由社區驅動的地圖未來願景,鼓勵貢獻,將塑造未來幾年地理空間服務的格局。

立即購買於

Related News

1 天前

Coldware:將區塊鏈與可用硬體結合Coldware ($COLD) 在區塊鏈領域取得了顯著進展,通過將硬體與區塊鏈技術相結合。目前,該項目正處於預售階段,僅剩 37% 的代幣,價格為 0.00625 美元。Coldware 旨在創造一個硬體與區塊鏈之間的無縫橋樑,專注於可用性而非模糊的承諾。通過提供像 Larna 2400 智能手機和 ColdBook 筆記型電腦這樣的設備,這些設備一打開盒子就能作為輕節點運行,Coldware 正在使得用戶更容易參與去中心化金融 (DeFi),而無需複雜的設置。該項目由 $COLD 代幣提供支持,該代幣促進交易、治理和質押獎勵,同時還允許用戶通過一個名為 Freeze.Mint 的獨特功能創建自己的代幣。

在更廣泛的區塊鏈項目中,Pi Network 和 Theta Network 也是值得注意的競爭者。Pi Network 擁有超過 6000 萬的龐大用戶基礎,但最近代幣價格的波動引發了對透明度的擔憂。儘管如此,Pi Network 仍在推進,設立了一個 1 億美元的基金來支持其生態系統內的新項目。與此同時,Theta Network 專注於去中心化視頻基礎設施,並最近推出了一項 AI 模型 API 服務以增強其產品。雖然這兩個項目都有潛力,但它們尚未實現大規模採用,這仍然是它們未來成功的關鍵因素。

總體而言,Coldware 通過優先考慮實際可用性和隱私來區別自己。與許多仍處於概念階段的加密項目不同,Coldware 已經提供了功能性硬體和以隱私為重點的操作系統。隨著預售的進行以及將區塊鏈整合到日常設備中的獨特方法,Coldware 為希望進入 Web3 領域的投資者提供了一個有吸引力的機會。隨著市場的發展,這些項目的成功將取決於它們能否為用戶提供具體的好處並實現廣泛的採用。

1 天前

Coldware:為可用的 Web3 體驗架起硬體與區塊鏈的橋樑Coldware ($COLD) 正在通過將硬體與區塊鏈技術整合,在區塊鏈領域取得重大進展。目前,該項目處於預售階段,僅剩 37% 的代幣,價格為 0.00625 美元。Coldware 旨在創建硬體與區塊鏈之間的無縫橋樑,專注於可用性和現實世界的應用。與許多依賴模糊承諾的加密項目不同,Coldware 提供了具體的產品,如 Larna 2400 智能手機和 ColdBook 筆記本電腦,這些產品設計為可直接插入生態系統並作為輕節點即插即用。

在更廣泛的加密貨幣環境中,Coldware 並不孤單。Pi Network 和 Theta Network 也以獨特的方式留下了自己的印記。Pi Network 擁有超過 6000 萬用戶,專注於移動優先的加密採用,但在一筆重大代幣轉移後面臨與透明度相關的挑戰。儘管如此,Pi Network 正在積極投資其生態系統,推出了一個 1 億美元的新基金。另一方面,Theta Network 正在去中心化視頻基礎設施中開創一個利基市場,最近推出了一項 AI 模型 API 服務,以增強開發者的能力。然而,這些項目是否能實現大規模採用仍有待觀察。

Coldware 的獨特之處在於其對可用性和隱私的承諾。其自定義操作系統旨在阻止追蹤器並最小化數據洩漏,與主流技術解決方案形成鮮明對比。Coldware 專注於提供即插即用的 Web3 體驗,不僅針對加密愛好者,還旨在吸引更廣泛的受眾。隨著預售的持續,該項目為早期投資者提供了一個獨特的機會,讓他們參與一個已經運營並專注於現實世界可用性的平臺。

2 天前

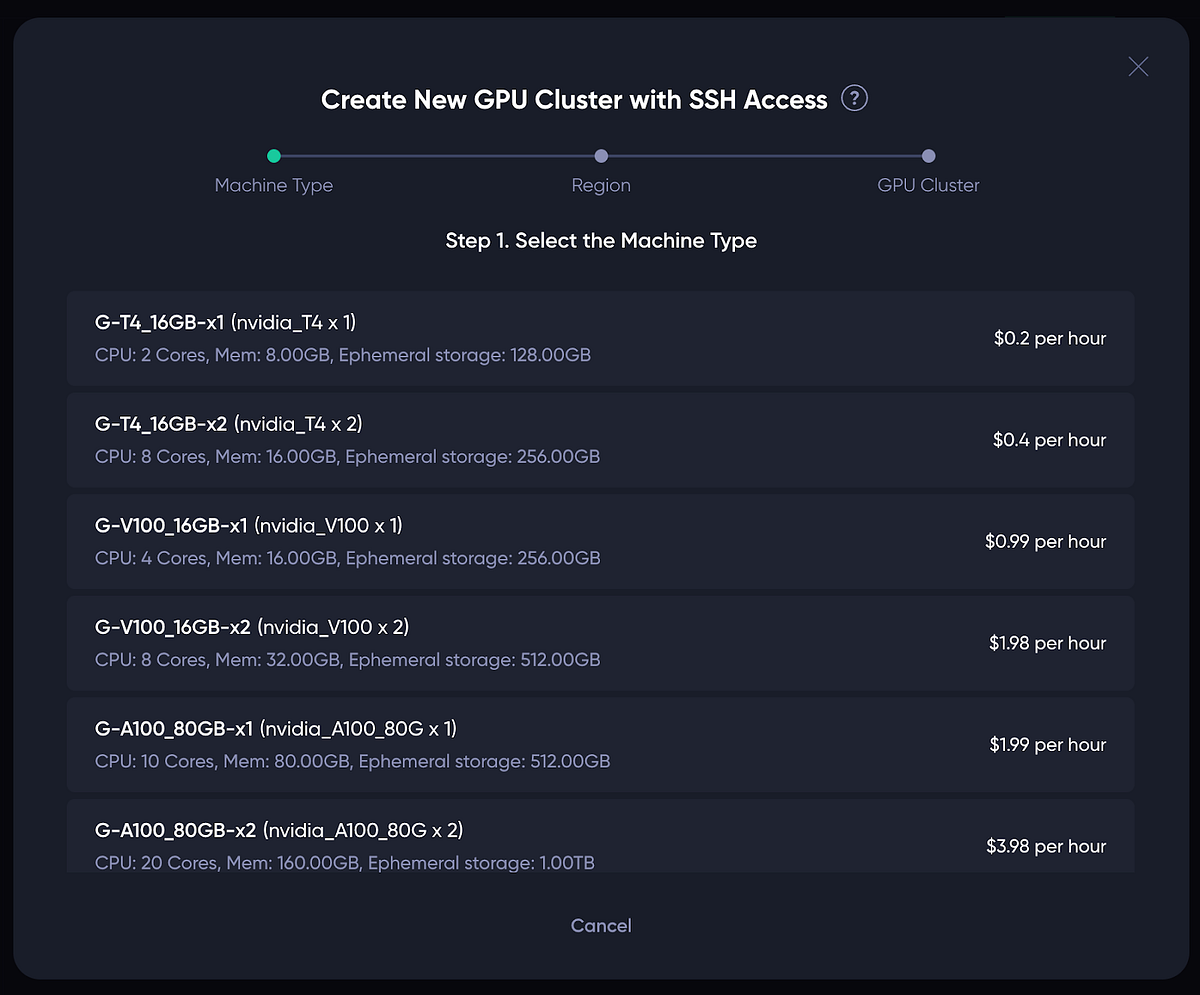

Theta EdgeCloud 推出 GPU 集群以增強 AI 模型訓練Theta EdgeCloud 透過啟用用戶啟動 GPU 集群,為大型 AI 模型的訓練引入了一項重要增強。這一新功能允許在特定區域內創建由多個相同類型的 GPU 節點組成的集群,促進節點之間的直接通信,並且延遲最小。這一能力對於分佈式 AI 模型訓練至關重要,因為它允許在設備之間進行並行處理。因此,傳統上需要在單個 GPU 上完成的任務,現在可以在幾小時甚至幾分鐘內完成,顯著加快了 AI 應用的開發週期。

GPU 集群的引入不僅提高了訓練效率,還支持水平擴展,允許用戶根據需要動態添加更多 GPU。這一靈活性對於訓練大型基礎模型或超過單個 GPU 記憶體容量的數十億參數架構特別有利。許多 EdgeCloud 客戶,包括領先的 AI 研究機構,對此功能的需求表達了意見,突顯了其在 Theta EdgeCloud 作為 AI、媒體和娛樂領先的去中心化雲平台持續演變中的重要性。

要開始在 Theta EdgeCloud 上使用 GPU 集群,用戶可以遵循一個簡單的三步驟流程。這包括選擇機器類型、選擇區域以及配置集群設置,如大小和容器映像。集群創建後,用戶可以 SSH 進入 GPU 節點,使他們能夠高效執行分佈式任務。此外,該平台還允許 GPU 集群的實時擴展,確保用戶能夠無縫適應變化的工作負載。總體而言,這一新功能使 Theta EdgeCloud 成為去中心化雲空間中,特別是針對 AI 驅動應用的競爭者。

3 天前

2025年值得關注的頂級加密貨幣代幣:BlockDAG、Toncoin、Litecoin和Filecoin隨著2025年的臨近,加密貨幣市場充滿了對哪些代幣將成為今年表現最佳的猜測。投資者正將焦點從單純的炒作轉向實際的進展、採用率和戰略市場定位。在領先者中,BlockDAG正獲得顯著關注,與已建立的參與者如Toncoin、Litecoin和Filecoin並駕齊驅,每個代幣都提供值得關注的獨特優勢。

BlockDAG以其雄心勃勃的交易策略引起了轟動,計劃在6月13日於20個集中交易所上市。這一激進的舉措不僅僅是為了提高可見度;它標誌著擴大市場影響力的準備。BlockDAG已籌集超過2.73億美元,並且目前正在進行預售,已經售出超過214億枚代幣,為早期投資者帶來了可觀的回報。其混合模型結合了DAG的可擴展性和工作量證明的可靠性,吸引了開發者和礦工,將其定位為加密領域中的一個嚴肅競爭者。

另一方面,Litecoin在加密領域仍然是一個可靠的選擇,以其快速的交易和低費用而聞名。它在跨境支付中的潛力正在獲得關注,吸引了尋求傳統信任和未來實用性結合的投資者。與此同時,Toncoin受益於與Telegram的整合,為數百萬用戶提供無縫訪問,增強了其採用前景。最後,Filecoin正在其去中心化存儲中開辟出一片天地,滿足對安全數據解決方案日益增長的需求。這些代幣各自提供獨特的機會,但BlockDAG的早期動力和戰略路線圖可能使其在2025年競爭激烈的加密市場中佔據優勢。

3 天前

Roam:用區塊鏈技術徹底改變WiFi共享在向去中心化連接的創新轉變中,Roam正在改變用戶共享其互聯網連接的方式。通過允許個人將私人和公共WiFi貢獻給全球網絡,Roam使用戶能夠將未使用的帶寬變現,同時為其他人提供可靠的互聯網訪問。這種模式不僅增強了連接性,還通過Roam Points獎勵用戶,這些點數可以轉換為$ROAM或用於參加各種應用內活動,包括遊戲和獨家活動。

在共享互聯網連接時,安全性和隱私是至關重要的問題,而Roam通過建立在區塊鏈技術上的強大安全框架來解決這些問題。用戶可以通過Roam應用程序完全控制其WiFi共享偏好,允許他們根據需要添加、編輯或刪除熱點。該平台確保所有連接都經過加密,保護主機和訪問網絡的用戶的個人數據。此外,每個Roam帳戶都被分配一個獨特的去中心化身份(DID),進一步增強用戶的隱私和數據管理。

Roam的快速增長顯而易見,擁有超過200萬註冊用戶和超過350萬個WiFi熱點在全球範圍內進行映射,使其成為WiFi覆蓋的領先去中心化物理基礎設施網絡(DePIN)。這一擴展得益於多樣化的用戶基礎,包括學生、旅行者和當地企業,他們不僅是消費者,還是網絡的積極貢獻者。通過下載Roam應用程序,用戶可以輕鬆共享他們的WiFi並獲得獎勵,從而參與增強全球連接的社區驅動努力。

4 天前

成均館大學的AIM實驗室採用Theta EdgeCloud推進AI研究成均館大學的AI與媒體實驗室(AIM Lab)由洪成恩教授領導,已成為全球第32所採用Theta EdgeCloud的學術機構,這是一個專為AI和機器學習研究量身定制的去中心化GPU基礎設施。這一合作將顯著提升AIM Lab在多模態學習、領域適應和3D視覺等領域的能力。值得注意的是,他們最近的工作,得到三星的支持,題為《音視覺問題回答的問題感知高斯專家》,已被接受為CVPR 2025的亮點論文,這是最具聲望的AI會議之一。Theta EdgeCloud的整合將使研究人員能夠按需訪問高性能的GPU資源,促進更快的迭代,同時降低成本。

洪教授是一位多模態AI和機器人感知的專家,他強調Theta EdgeCloud在提供必要的計算靈活性以推進他們的研究方面的優勢。AIM Lab專注於視覺-語言建模和隱私保護的領域轉移,將受益於去中心化的架構,使模型的訓練和評估變得更快。與三星的合作進一步加強了實驗室的研究產出,展示了促進影響力AI技術發展的戰略關係。

AIM Lab最近的成就,包括創新的QA-TIGER模型用於視頻問題回答和一種內存高效的注意機制用於圖像分割,突顯了該實驗室對尖端研究的承諾。通過加入一個利用Theta EdgeCloud的知名機構網絡,如斯坦福大學和KAIST,成均館大學有望在AI創新推進中領先。這一合作不僅加速了研究,還使AIM Lab位於發展社會相關AI應用的前沿,展示了學術與企業合作在科技領域的力量。

註冊以獲取最新的DePIN新聞和更新